These are some of the clients I served over the years. Most of them are HDB upgraders who are using their first pot of gold to jumpstart and build their wealth using property as their primary investment vehicle.

That being said, this path is not easy or suitable for all HDB owners. Not everyone should upgrade to private property.

Client #1: Upgrade from 3 bedder to 4 bedder private condo

Owner of this unit has been wanting to upgrade for a while, however, they delayed their plan as the previous agents could not get the price they were looking for.

After contacting me on facebook on their possible options to grow their asset, they decided that they prefer to get a bigger property instead of getting 2 properties. Which works as well because they upgraded to a bigger property in a better location.

After 2 rounds of discussions to understand their requirements, we eventually narrow down their choice from Sengkang/ Punggol/ Tampines to Kovan vicinity.

The choice was made based on the proximity to MRT Station/ Amenities/ layout/ size requirements and upside potential.

I saw an opportunity for capital gain because of the new launch pricing along Woodleigh and Potong Pasir.

It was love at first sight for this client. Now they have a home that they really loved. High floor, pool view, right next to MRT station and already sitting on paper gain of approximately $150k.

Client #2: Upgrade from HDB to 2 Private Properties

Without additional cash from their savings and having to incur Additional Buyer Stamp Duty, this couple upgraded from a 4rm HDB in Sengkang to 2 private properties. One for own stay , less than 5 mins walk from the MRT Station and a huge Mega Mall. The other is a 2 bedder for investment generating a passive income.

When this couple first met me, they have already placed a booking fee for an Executive Condominium.

After having few rounds of discussion and proposal, they eventually forgo the deposit for the executive condo and bought 2 private properties instead.

You might be wondering why would I advised them against an Executive Condominium? There is no best property, only most suitable property in my opinion. An executive condo will have a MOP period of 5 years, with another 2 to 3 years construction period, it will be approximately 8 years before they can make any profit or own a second property. While this might be good for some, they possibly can grow at a faster pace should they go for private.

This is exactly why I always stressed that there is no 1 size fit all proposals. Every single Asset Progression Plan I did is done with the full involvement of my clients, 100% customized to suit their unique profile and scenario.

Client #3: Upgrade from HDB to Private Condominium

This client called me wanting to know more about upgrading to a private 3 bedder from a HDB. They wanted to know how this can benefit their family in a long run. They also wanted to ensure that the down payment and monthly commitment is well within their affordability.

She fell in love with the first project I recommended her. While this project is not in the location she was looking at, it is nearby and it fulfilled all her requirements and is much cheaper than what she expected. She saw this project twice and made a decision to commit.

She was originally was looking at a budget of approx $1.3mil for a 3 bedder unit, but eventually bought brand new 4 bedder for less than $1.2mil in 2017. Today, another neighboring project is transacting averagely $1250psf.

Client #4: Upgrade from DBSS to 2 private properties

This couple came to see a condo unit that I was marketing in the East Coast.

After knowing that no agents have ever shared with them their housing options and they do not have a clear idea of how they can continue to grow their asset, I invited them to a 1-1 sharing session whereby I shared with them various strategies and options to grow their asset.

Eventually, they bought a unit in the project they really loved (the project we met), a spacious 3 bedder unit, high floor with unblock sea view and Marina Bay view.

With careful planning, selection of property and financial calculation, they were able to invest in another property without over-stretching and incurring Additional Buyer Stamp Duty.

Client #5: HDB Upgrade to Private Condo

This family was referred to me by another client who likewise engaged my service for Asset Progression.

They were initially rather hesitant about upgrading and only meet me to because of the friend.

Like most of us, there will be a very natural fear of over-committing ourselves financially. After understanding how this upgrading can help build their retirement nest egg and is within their means, they were happy to upgrade to a brand new condo with a beautiful unblock river view.

By upgrading, they are holding asset that have a better appreciation and they also get to enjoy a better lifestyle.

Client #6: HDB Upgrade to Freehold 3-bedder Penthouse

This couple called me from Facebook. They saw my adverts a couple of times and out of curiosity wanted to know why I am encouraging HDB owners to upgrade.

They were living in a 5rm HDB which is very spacious and well-renovated. It is surrounded by amenities, coffeeshop, grocery store etc. They knew that if they upgrade, they will not have such luxury of space anymore. What’s more, their HDB is not that old to be a concern.

With a better understanding of HDB vs Private, detail figure crunching and proposals, they decided to take action. We managed to work out the upgrading plan according to the budget and monthly installments they are comfortable with. Something they will not have to stress about.

Currently they are living in a brand new freehold 3 bedder penthouse, within walking distance to a MRT Station, shopping mall and town centre.

Client #7: 1 fully paid private property to 2 private properties

This is a very interesting case study that I believe can benefit the readers.

Most owners in this situation will probably not do anything.

This couple originally owns a fully paid condominium. Now they own a freehold 2 bedder dual key unit in with a 3% rental yield and another private condo in a location with massive transformation going on.

You might be wondering, why would an owner with a fully paid property do this? Or rather, why would I recommend the owner to do this:

- The price of the property they previously owned has stagnated. It has aged and lost the appeal to attract good upside and it is still way too young to for typical en-bloc sale to go through.

- While the property has been fully paid, CPF money was used very substantially and is still incurring a lot of accrued interest (even though the property is fully paid).

With the price stagnated, they will be receiving lesser and lesser in cash should they sell the property later on.

By selling and re-allocating the funds, now they not only get to enjoy a higher rental yield, but also an estimated paper gain of more than $200k despite the latest cooling measure. A look back at the property they sold, the price is still about the same.

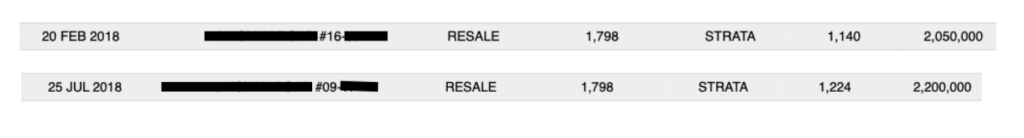

Client #8: From East Coast to CBD

This is a case of upgrading of their property portfolio. This client owns a nice 3-bedder leasehold property in Tanjong Rhu. While there is nothing wrong with the property she previously owned, in order for her to continue growing her asset without incurring ABSD – we proposed upgrading her investment to a 2+study in CBD.

With this upgrade, she not only increased the value of her portfolio but also positioned herself to benefit more from the future market upcycle and transformation in the CBD.

I recommended her a specific 2+study layout that can be converted into a very comfortable 3 bedder. With this change, we rented out her unit very quickly as her unit was considered as the cheapest 3-bedder unit around.

Plus her rental is a lot higher than the rest of the 2 bedder units. Creativity wins!

Client #9: : 1 private property to 2 private properties

From a high floor private condominium with an unblocked view of a beautiful park, this couple restructured their portfolio into 2 private properties.

After our first presentation based on facts and figures, they were very quick to realize that the property they were living in has already reached a point where the prices are stagnating.

In order to help them grow at a faster pace, we need to unlock the profits and loan paid up over the years. This could typically be done through re-financing/ part-share.

However, as the growth of this property has slowed down due to TDSR, and the clients no longer has a need to stay there, we all agreed it is unwise to incur additional cost to hold it.

So, the property was sold in less than 2 weeks and reinvested into 2 other private properties with huge upside opportunity. One for own stay while the other as an investment.

Client #10: From HDB to Private Property

You might be wondering why would a family staying in a huge HDB maisonette wants to move to a smaller 3 bedroom private condominium?

This family did just that, and after they moved, they were so happy with the decision, they started recommending me their friends.

There is really nothing wrong with a HDB, it is a great solution to our housing needs.

However, we need to acknowledge that HDB policies has a mandate to keep the prices affordable. So growth will always be limited.

This might mean that when the time comes for my client to retire and they need additional funds for their retirement years – they might not be able to cash out a lot.

Especially if they choose to downgrade from their maisonette to a smaller HDB.