I am a property agent.

So you can imagine I am someone who is always bullish and optimistic on the Singapore property market.

That being said, I am also not someone who tells people to invest blindly in property.

Proper analysis and prudence is still necessary – you want to make sure you got the holding power to remain invested for a long period of time.

2024 might feel like a time for pessimism.

- Hold back and throw any liquidity into safe investments like fixed deposits.

- Wait for interest rates to be cut.

- Remain bearish on the Singapore property market.

Personally, I think you should always be aware on what’s happening on the ground in the property market before jumping to any conclusions.

Otherwise, you might just miss out on the opportunities.

In May 2024, there was a this news report:

Basically, the number of condo resale transactions hit a 13-month high in April, with 1,122 units changing hands.

I think it’s interesting to note this – there are observations that buyers are turning to resale private property market instead of the new launch market.

Here are 7 reasons why you should be more confident:

1) Interest rates have now moderated since last year. It is no longer as high as before.

(The above bank rates are estimates for reference only, taken around May 2024)

The interest rates has moderated since it starts climbing up around July 2022 to as high as 4.5%.

It has been almost 2 years since.

Buyers who were previously sitting on the fence waiting for the interest to moderate as probably feeling that now is the time to enter as the rates becomes more attractive.

2) TDSR has created stability in the property market

The Total Debt Servicing Ratio has created an environment where there is no excessive borrowing taking place. It has protected borrowers from over-extending themselves.

This promotes long-term market sustainability and reduces the risk of a property bubble.

That is also the reason why most property owners today have great holding power.

That being said, for those who wish to exit the market and sell off their property will face resistance to sell their property at higher prices in the resale market.

3) Property supply has increased and rental rates has dropped

In 2023 and 2024, many developments have been hitting TOP. These new supply of newly-completed units will make resale owners to be more realistic in their asking price.

At the same time, monthly rental rates has also started to drop.

So we are at a point now where the supply is able to meet demand.

And the increased supply means more choices and an ability for buyers to have greater negotiating power.

But moving forward from 2024 to 2027, the supply will be much lesser.

And when supply goes down, that presents an opportunity for owners to let go of their units.

Recently, those who benefited the most was those owners who took the opportunity to let go of their units in 2021 and 2022 – when there were construction delays and demand skyrocketed.

Your next question might be:

“But Darius, the property supply is still going up eventually. I am not sure if the benefit is worth the effort.”

My answer to that question?

Read on below.

4) ABSD has locked up the “liquidity” of properties

There is an interesting phenomenon that is happening amongst foreign owners and foreign investors of private properties in Singapore.

They bought their property units before the 60% foreigner ABSD was applied on April 2023. So while they might have made good gains and returns from their private properties, they are also stuck.

If they were to sell their current property, they would have to pay a painful 60% ABSD tax for their replacement property.

That is why many are reluctant to let go of their current property and would rather continue to hold on to their existing property holdings.

Similarly, Singapore citizens who owns 2 properties – 1 for stay and 1 for investment – are also reluctant to let go of their existing properties. The idea of exiting and buying back is not attractive due to increased ABSD.

Those who own one property for personal use might consider selling, but they will likely buy another property afterward.

This behavior does not increase the overall supply of resale properties unless they choose not to purchase another private property.

Overall, the ABSD restricts the number of resale properties available in the market, limiting supply.

5) Increased property taxes have discouraged property investors even more

One factor that might encourage property owners to consider selling their rental properties is the increase in property taxes for non-owner-occupied homes.

This is particularly true for owners who purchased their properties before 2013, when the Additional Buyer’s Stamp Duty (ABSD) was introduced.

These owners likely bought their properties at lower prices and have had them for over 10 years, resulting in significant equity.

Despite the recent property tax increases, they still enjoy a substantial net rental income due to their long-term investment and the lower initial purchase costs.

The increased property taxes will slowly erode their gains and profits – but it is not painful enough yet for them to let go and sell of their property.

Some of my clients have already swapped their rental properties for new launches, which are not subject to these higher property taxes yet.

However, this trend is not widespread.

6) The 15 Months’ Restriction on HDB Downgrading

Private property owners under 55 years old must wait 15 months after selling their property before they can purchase an HDB flat.

Those over 55 years old are restricted to buying a 4-room HDB flat or smaller.

This policy discourages potential sellers who wish to move back to an HDB flat, especially affecting those under 55.

If you are a private condo owner who might be looking to downgrade to HDB, you will feel it is better to delay until you are 55 years old.

Most private property owners might prefer to stay put instead of renting for 15 months.

Consequently, this tightens the supply of resale private properties.

7) New launch inventory is a buffer against increasing prices

When multiple developers have this much property inventory left, it is unlikely they will want to increase prices too much.

It will scare away their pool of potential buyers.

At the same time, developers are monitoring the sales results of their own competitors – so they will have to be very sensitive on setting their selling prices.

While we are not in an oversupply situation, it also means developers are facing their own “pressures”.

This also means getting good deals is possible – if you know where to look.

Some Thoughts on Human Psychology

Have you ever met people who will try to discourage you from doing certain things but instead they themselves quietly try it out?

They will tell you things that:

- property market will crash

- investing in property is a waste of time

- the economy is in a recession

- people are losing jobs

I’ve met some people like that. It’s their way of “reducing competition”.

While some of their advice might be well-meaning, I also like to caution you to not blindly listen to “other” people.

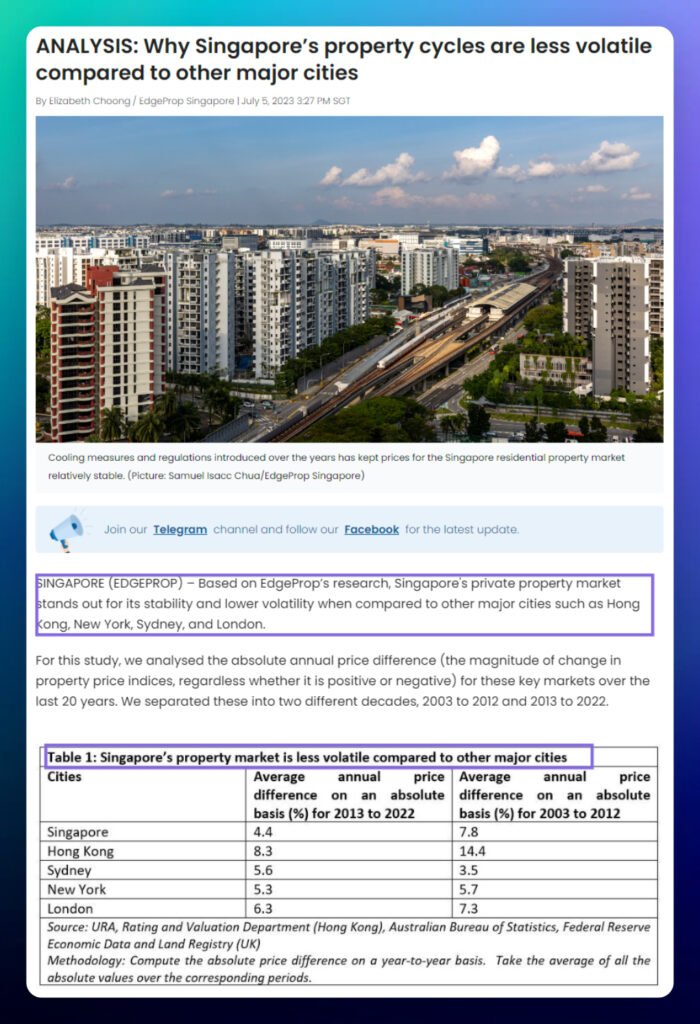

Looking at the fundamentals of the property market in Singapore, a crash is very hard to happen due to the safety rail guards like TDSR, MSR and ABSD.

In Singapore, it is actually governed more due to factors like demand and supply.

As someone who deals with sellers, buyers, investors, tenants on a daily basis – property is one of those tangible and yet emotional investments.

When the right emotions are in play, the returns of a property investment can be beyond your wildest expectations.

Loan vs Age: The Older You Are, The Smaller The Property Loan Granted To You

The good thing about TDSR is it really prevents property buyers from being in an over-leveraged position. This means that the borrowers are those who have a strong ability to repay the loan.

But there is a flip side.

This also means that borrowing becomes quite restrictive. As the age of buyers increases, their loan amount is also reduced.

This means if you wait out for too long, you might not be able to purchase the property of your choice as the loan granted to you might not be as high as you need.

This is something for all future buyers to think about – by delaying your purchase, you essentially need to fork out more of your cash.

Age vs Estimated Loan Granted (TDSR) | ||||

|---|---|---|---|---|

Age (Years) | $5,000 Monthly Income | $10,000 Monthly Income | $15,000 Monthly Income | $20,000 Monthly Income |

34 | $521,176 | $1,054352 | $1,581,528 | $2,108,704 |

36 | $519,041 | $1,038,083 | $1,557,123 | $2,076,166 |

38 | $501,568 | $1,003,136 | $1,447,041 | $2,006,272 |

40 | $482,357 | $967,714 | $1,447,071 | $1,929,428 |

42 | $461,235 | $922,470 | $1,383,705 | $1,844,940 |

44 | $438,013 | $876,025 | $1,314,039 | $1,752,050 |

46 | $412,481 | $824,962 | $1,237,443 | $1,649,924 |

48 | $384,410 | $768,819 | $1,153,230 | $1,537,638 |

50 | $353,547 | $707,094 | $1,060,641 | $1,414,188 |

52 | $319,615 | $639,229 | $958,845 | $1,278,458 |

54 | $282,308 | $564,615 | $846,924 | $1,129,230 |

Conclusion

People often ask me whether is it possible to time the property market.

“Can we enter at the best time?” is a common question I always get.

I usually discourage that because I believe you should buy a property when you need it.

But what I see happening on the ground right now – it is a sweet time to consider a property purchase.

Why?

All the factors are coming together to moderate the prices in such a way that I think it is the best time to get a good deal.

However, do be aware of this fact though…

The government is taking all the various steps to discourage people from “overly investing” in property.

- ABSD has been around for more than 10 years and the rates keeps increasing.

- Property tax has been increased.

- Restrictions to downgrading has been implemented.

- Foreigners seems to be discouraged from buying private property (unless they commit to Singapore by becoming PR or citizen)

This means, your best chance to make a profit is on that FIRST and ONLY property that you purchase – the one that you stay in. That will truly be the most profitable investment you can achieve.

And that’s why I named this website as “Choose The Right Property”.

This is because you essentially only have 1 chance to make the right choice.

If you plan to explore what are your property choices, I invite you to contact me for a no-obligation discussion.