Most people focus on headlines like “Prices stabilizing” or “More supply coming”.

But if you want to make smart property moves in 2025, you have to understand what is actually happening beneath the surface:

1. Buyer & Seller Psychology Will Shape the Market More Than Prices

Yes, prices are stabilizing, but that doesn’t mean deals will happen easily.

Buyers are hesitant, fearing they might overpay, while sellers struggle to adjust to the new reality.

This could lead to a longer negotiation process and fewer transactions overall.

Which means opportunities for buyers who are decisive and well-prepared.

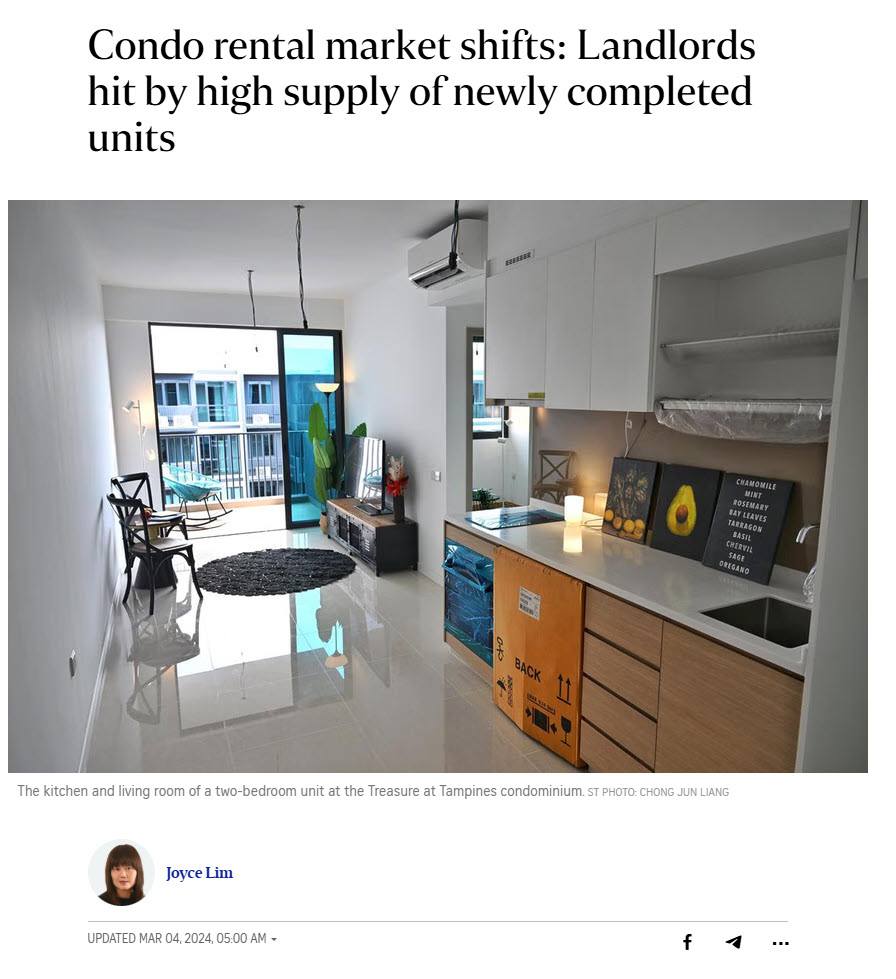

2. A Softer Rental Market Could Tighten Financing for Investors

With more rental units hitting the market, landlords might face pressure to drop rents.

But what’s less obvious?

Banks factor rental income into financing decisions.

If projected rental yields decline, banks may get stricter with loans.

This will make it harder for investors to refinance or expand their portfolios.

Some overleveraged landlords may even be forced to sell, opening up rare buying opportunities.

3. Not All Areas Will Be Affected the Same Way

A casual observer might assume the whole market is slowing down.

But in reality, some locations will hold their value better than others.

🏡 Mature estates with limited new launches? Likely to remain strong.

📉 Oversupplied districts? Expect steeper price and rental corrections.

🚆 New MRT lines & infrastructure upgrades? These can create pockets of resilience, even in an overall weaker market.

4. Government Policy Is a Wild Card

The cooling measures are working. This is especially so for the 60% foreigner ABSD.

But if the market slows too much, don’t be surprised if the government steps in with adjustments.

A tweak in ABSD or loan rules could change the game overnight.

Those waiting for a major price drop might miss out if policies shift to support demand again.

5. Homeowners Will Drive the Market More Than Investors

With interest rates still high and cooling measures limiting speculation, the biggest buyers in 2025 won’t be investors.

It is most likely they are genuine homeowners looking to upgrade or settle down.

This means practical, well-located, livable homes will be in demand, while investment-driven “paper gains” take a backseat.

Conclusion: Play the Long Game, But Play It Smart

✅ If you’re a buyer – opportunities exist, but you need to act decisively.

✅ If you’re a seller – timing and positioning matter more than before.

✅ If you’re an investor – focus on cash flow resilience, not just appreciation.

Want to dive deeper into the data?

I have the full Residential Property Outlook 2025 report, packed with numbers and trends to help you make an informed decision.

As the leading real estate agency in Singapore with more than 14,000 agents, PropNex dominates the market in transaction volume and deeply understands the nuances of the local property landscape.

While headlines give you a surface-level view of the market, real opportunities lie in the details.

This means trends, policy shifts, and demand-supply dynamics that can impact your next move.

That’s why we’ve compiled the 2025 Residential Property Outlook Report—a data-driven analysis of where the market is headed, helping buyers, sellers, and investors make informed, strategic decisions.

If you are interested to access the full report, drop me a WhatsApp message below with the message: 2025 Property Market Report.

https://api.whatsapp.com/send?phone=6598801790&text=2025%20Property%20Market%20Report