Is Executive Condo (EC) the best option for you?

Under what circumstances will private condo be a more logical option?

Over the last couple of weeks, I have been seeing a lot of excitement due to multiple EC launches.

Even during my sharing appointments, when my clients discussed their upgrading plans with me, ECs are always one of the options they are seriously considering.

And why not?

I think we are all very familiar with the advantages of ECs which needs no introduction.

In this article, I would like to share about the disadvantages of an EC which are rarely addressed. Now, I am not saying that EC is not good. There is always 2 sides to a coin. It is definitely the best option for some of us.

So, under what circumstances will a Private Condo make more sense than an EC?

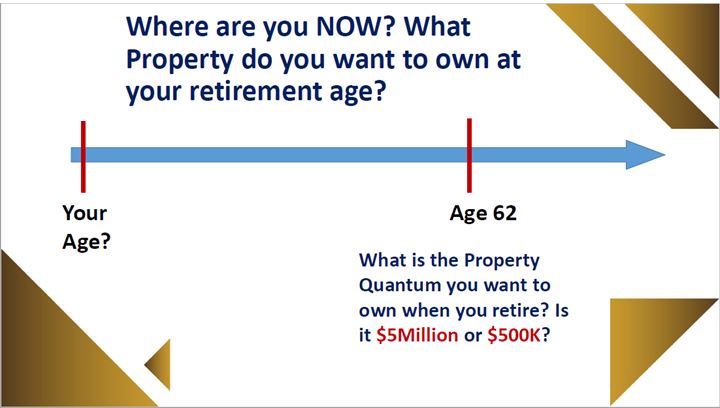

I think it all begins with where you want to be, what you have now, how long it takes to get there. This is critical because it will tell you how much time you have and how growth you need your property to have.

Let me illustrate this with an example that many of us can identify with.

Mr & Mrs Lim got married and moved into their HDB in year 2006 when they are both 28 years old.

(In 2011)

They sold their HDB in 4rm Sengkang for $490K when it reaches MOP. After clearing off mortgage, they have approximately $350k on hand.

They then bought a unit at Minton.

Below is the price of Sengkang 26X cluster in 2011 for your reference.

Prices of Sengkang HDB Blk 26X cluster In 2011

(In 2015)

Mr & Mrs Lim noticing that their property price has risen, decided to continue to make their money work hard for them.

They cashed out their Minton for a profit of approximately $200k.

Profitable Transactions for Minton, holding period from 2011 to 2015

At this moment, they have made a total of $350k profit from their HDB ($150k profit) and Minton ($200k profit).

Their funds on hand grew to $550k.

They decided they are ready to own 2 properties and they bought a unit at Sims Urban Oasis for investment and a High Park Residences for own stay.

(In 2019)

In 2019, Mr & Mrs Lim again cash out their High Park Residences for a $300k profit and Sims Urban Oasis for a $130k profit.

Profitable Transactions for High Park Residences, holding period from 2015 to 2019

Profitable Transactions for Sims Urban Oasis, holding period from 2015 to 2019

From the $350k they have from selling their HDB, they have grown their wealth to $980k in 8 years.

$350k (HDB) + $200k (Minton) + $300k (High Park) + $130k (Sims Urban Oasis)= $980k.

Mr and Mrs Lim has indeed achieved their dream of becoming a millionaire at 40 years old and on track to owning 3 properties with a passive income of $6000/mth when they retire.

Now, suppose they have continued to stay on in their HDB, the price of their HDB would have been still around the $480k.

During this period, their money have not worked for them and on top of that, they have to pay interest for their mortgage loan and accrued interest for CPF used.

This unfortunately has been a very painful scenario that I have seen very often. In fact there are many in worse situation with their HDB flat losing more than $100k in value.

Prices of Sengkang Blk 26X cluster in 2019

What if they have upgrade to an EC in 2011?

Let’s take a look at the profitability of some of the executive condos.

Prive

Austville

Canopy

Esparina

Arc AT Tampines

Looking at the profit margin for ECs, if they have upgraded to an Executive Condo in 2011, they will be able to make approximately $650k (only 1 unit Esparina) if they are that one lucky buyer.

Most owners will probably make around $200k (Do note that for EC profitability chart, I sorted them by max profit)

The other factor is the Risk Factor:-

For ECs, if a buyer is very unfortunate and bought the wrong one, spending 8 years making less than $150k, you would have wasted 8 years. To make matter worse, you cannot even buy another private property in Singapore or oversea even if there is unbelievably good opportunities presented to you.

For Private, because of the short holding period required, even if you made a wrong decision, you can sell it 3 years later so long as it is not making a loss.

Now, supposed Mr and Mrs Lim bought an EC in 2011, their progression will look something like this;

Please do not get me wrong, I am definitely not discouraging anyone to go for an EC.

There is really nothing wrong in whichever choice you made. My objectives is to give you some idea where exactly your choices will likely lead you to.

Whats most important is the the choices you made are leading you to where you wanted to be.

If you would like to know more:

- Is it still possible to make this kind of profit?

- Which is the best option?

- How to choose the right property with better chance of appreciation?

I do offer a no-obligation discussion where I can share with you in person. There is no easy answer to these questions as it really depends on a few factors and your own unique situation.

Property investment is never an easy decision because a lot of factors have to be considered.

Both financial & non-financial factors.

Being in the industry for 11 years, I’ve been blessed with the skills, knowledge and experience to help people around me with regards to their property.

If you are planning to do something and whats a second opinion – let me take a look at it.

We can have a detailed no-obligation discussion – based on your objectives, risk tolerance and financial position.

Drop me a WhatsApp message at wa.me/6598801790