Recently, a friend of mine called and asked me to help them sell their current HDB as it has reaches MOP and help them purchase a property that they have shortlisted.

I went on to asked why he wanted to move to that particular property as I am concerned my friend may lose money because that particular property price has stagnated with no foreseeable factors that will push the price up in the next 5 years or so.

Not so surprising to me (since I have met so many people), he actually is aware of the danger. However, he felt he has no choice. He wants to be in the same vicinity as the children are studying in the near by school. All their enrichment classes are also around there. This particular property seems to be their only choice within their budget and able to meet their minimum size and logistic requirements.

This situation that my friend is in is really very very common.

I have met so many buyers who made the most convenient decision to settle down to a property that can take care of their current needs. This is really very natural for all of us. But the danger is that the pain may come later, years down the road when they realise the price of the property did not appreciate and they did not grow financially to meet the future needs such as children’s tertiary education or their own retirement.

Of course, I am not saying this is wrong. We all have different priorities and we plan differently. We just have to be aware of what will likely happen in the future and take into consideration in our plan.

So, what can possibly solve this dilemma that many of us face?

If the price of property you need for own stay is going to be stagnant, should you go ahead with the purchase?

Does it make sense to buy a property for investment while staying in a rented property?

In this article, we will take a look at how by renting a place for own stay while investing in another property for financial growth might help you achieve the best of both world.

Scenario 1:-

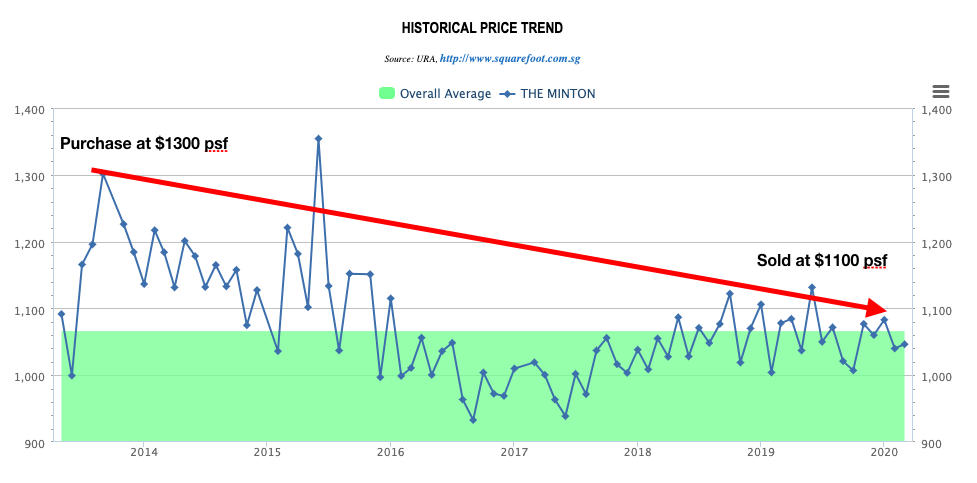

Mr Tan bought a 3 bedder unit at Minton in 2013. He bought a unit there because of his children study in the school opposite and also because his parent lives in the Lorong Ah Soo estate as well. The mindset he had then was that he was buying a property for own stay and not an investment as such, capital gain from the property is secondary.

To him, a property that can meet the needs of the family, good room size and fits his budget is the most important.

He bought it at $1300 psf, the prices came downwards shortly and in 2020, the property price is only about $1100 psf.

For a 1200 sqft unit, Mr Tan made a loss of $240,000 excluding interest and stamp duty.

This will make it very difficult for Mr Tan to invest in a 2nd property. In fact, he is probably stuck in this property with very no other option.

Scenario 2:-

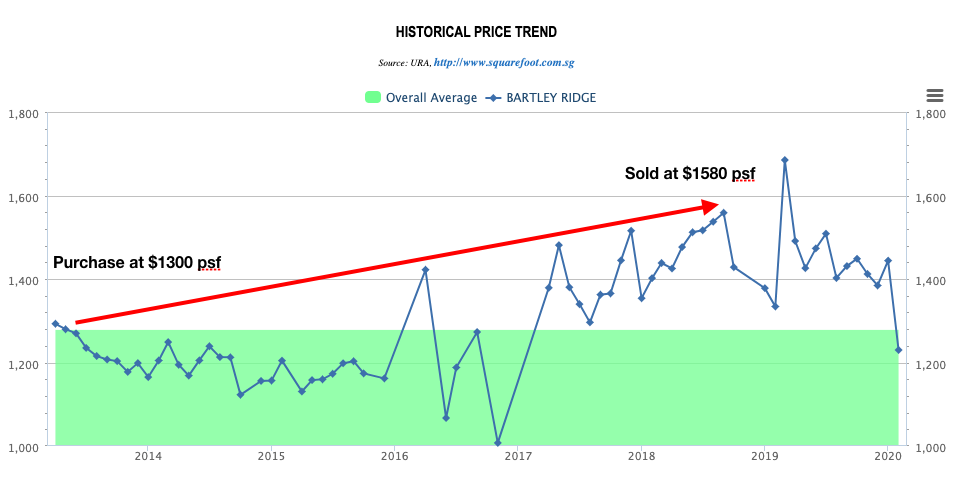

Now, supposed, Mr Tan did his research, and realised that price of Minton at that time has risen quite sharply and there doesn’t seems to be any contributing factors that will push up the price further.

In order to enjoy the convenience of living in Minton, while not having his funds stuck there, Mr Tan took the unconventional approach of renting in Minton.

He decided that his funds should be invested where he can make his money work for him. After doing his research and consulting with an agent who is able to objectively show him the facts and figures, he decided that Bartley Ridge makes a lot of sense and decided to purchase a unit there for investment, while staying in a rented unit in Minton.

Let’s take a look what happen?

Mr Tan would have bought Bartley Ridge 1200sqft 3 bedder at $1300psf and sold it in 2018 at $1580psf, making a profit of +$336,000 instead of a loss of -$240,000. A whopping half a million difference.

Since Bartley Ridge is an investment property, it is very easy for him to cash out and take profit without logistic headache and consideration.

With the profit he made from Bartley Ridge + his original fund he invested into the property, Mr Tan is now able to split his fund into 2 properties, potentially buying 1 for own stay and the other to rent out for passive income if he choose to.

—————————–

So, does it make sense to buy a property for investment while staying in a rented property?

I think it is very important to understand that not every property can appreciate. It is also very important to be very clear about whether the property that you wanted to stay, will it appreciate or not? If the price is going to be very stagnant or even come down, are you really ok with it?

Personally, I would think that unless you are already financially very comfortable with more than one property, you should seriously think about compromising on the upside potential.

The rental strategy might be a good solution to help you achieve the best of both world.

Here’s some tell tale sign of a property that might not appreciate;

- Older Pte condo with no en-bloc potential in the next 5-10 years.

- No transformation nearby to push up the price.

- HDB growth are typically slower as compare to pte condo.

- Projects that have appreciated significantly very recently and the growth has now slowed down.

- Price of resale condo will typically stabilises shortly after TOP.

To more accurately assess the potential of a property, thorough research on the property is necessary and I use professional tools to do my research as well as price comparison. You will also need to be trained to interpret datas and pricing charts.

If you are not very certain that you are doing it right and would like me to help you take a look, please feel free to give me a call. Alternatively I can also work out a customised proposal with you.

Property investment is never an easy decision because a lot of factors have to be considered.

Both financial & non-financial factors.

Being in the industry for 11 years, I’ve been blessed with the skills, knowledge and experience to help people around me with regards to their property.

If you are planning to do something and whats a second opinion – let me take a look at it.

We can have a detailed no-obligation discussion – based on your objectives, risk tolerance and financial position.

Drop me a WhatsApp message at wa.me/6598801790