Few days ago, one of my FB friend asked me to help her look into a property she is interested in, like most buyers, she wants to know if she is making the right decision.

As I looked into the project, I saw a CRITICAL TREND that I would like to share in this article.

I have come across many buyers looking for the best project, without a proper understanding whether the project is suitable for them or not.

Many home buyers are not aware that one of the key consideration in choosing a property is knowing when you have to sell.

This is because different property have different exit point and strategy.

If these can be aligned with when you will probably be selling, your chance of making good return can be maximized.

In this article, I wish to highlight the importance of knowing your holding time horizon and the exit point.

A critical factor in choosing the right property is when do you intend to sell?

To maximize profit, your investment horizon must be align with the exit points.

Nowadays, most of the buyers I have spoken to are already aware that at TOP prices will typically goes up. Although not always the case, most of the time it does happens. My concern is more on how long do you intend to hold the property.

Having an exit time horizon is critical to your profitability.

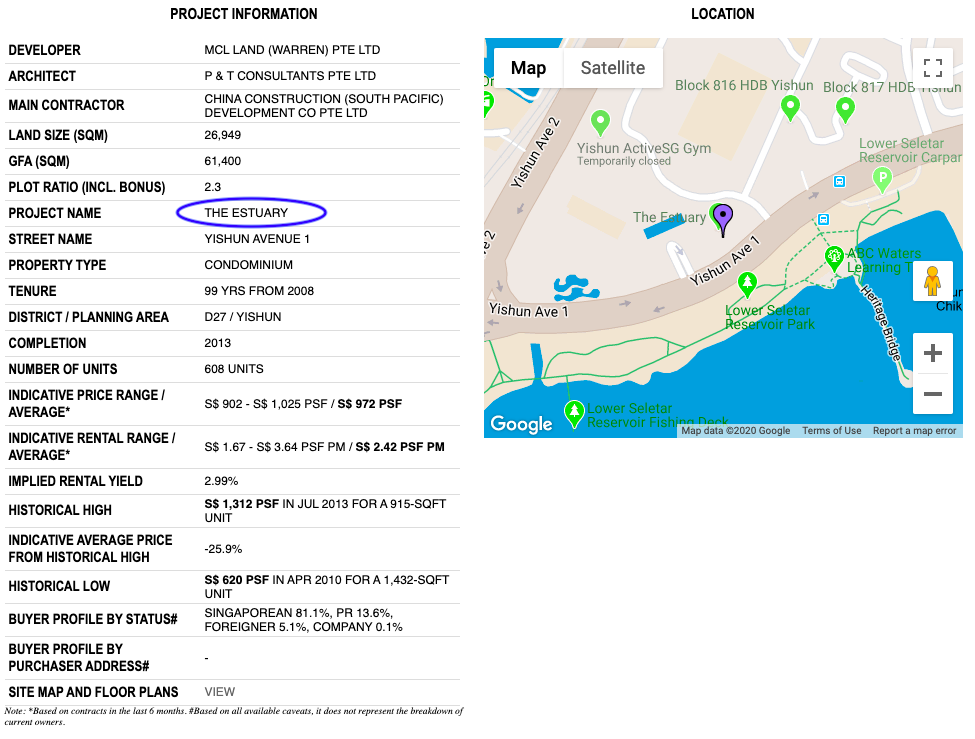

Let’s take a look at this project The Estuary located in Yishun Ave 1.

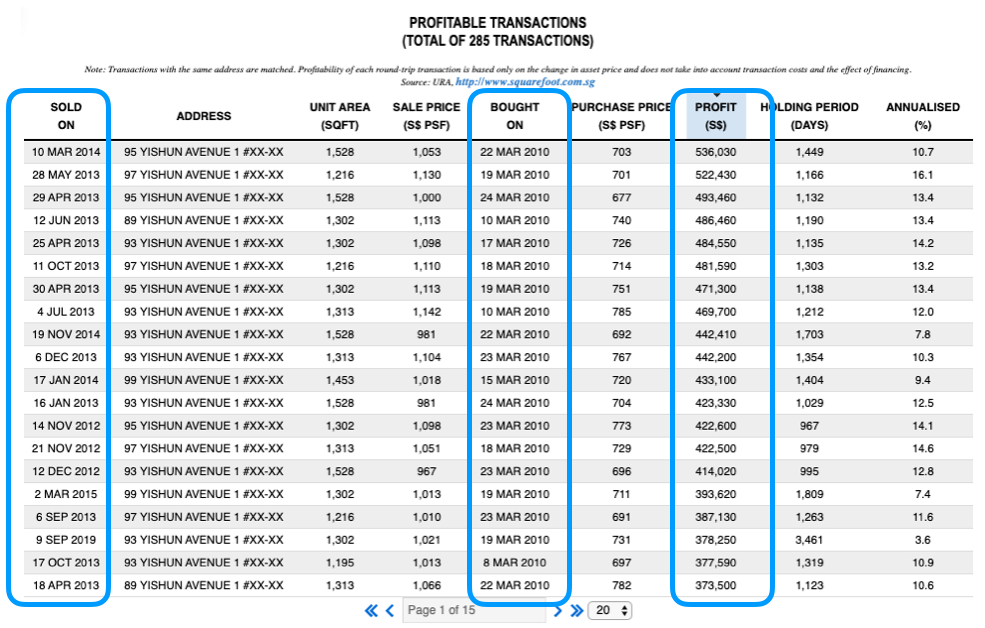

I was very surprised to see some owners making as much as $500k in just 3 years time, which are rather amazing given that many of us might not consider Yishun the most popular location.

In the past I have heard so many people advocating LOCATION LOCATION LOCATION when it comes to property investment. With this example, it become very clear, that other than location, there are other factors that contributed to this MASSIVE PROFIT.

In this article, we will take a closer look and also do some comparison.

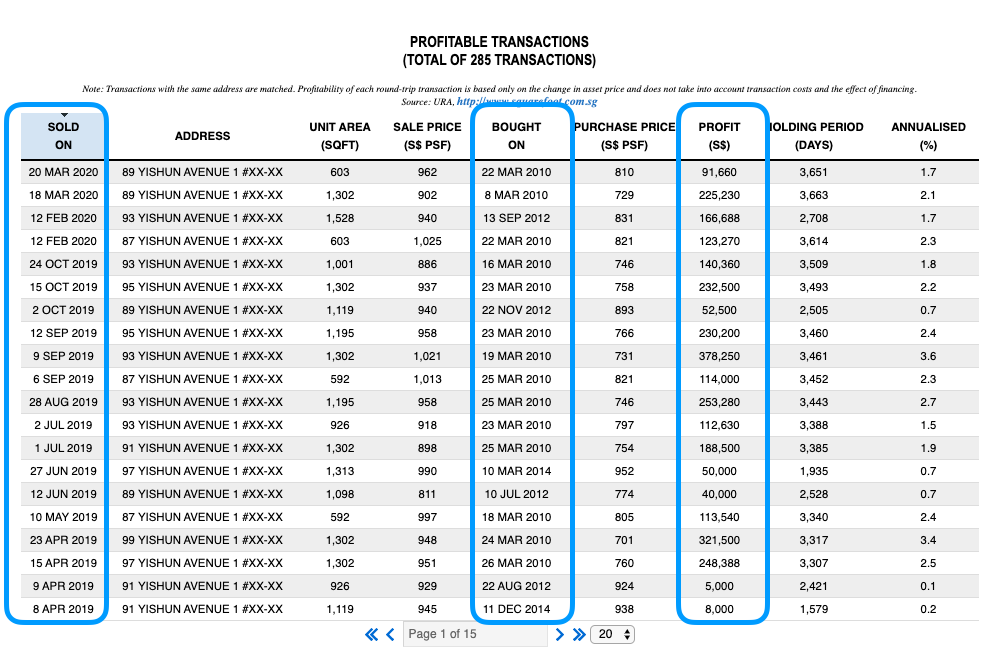

If you take a look at the profit of those units bought in 2010 and sold around 2019, you will see from the chart below that the profit have reduced very significantly and they paid much more in interest.

We can see from this example that the belief that the longer you hold the more you make is really untrue.

Some of you may be wondering, is this because 2013 is a better market compared to 2019?

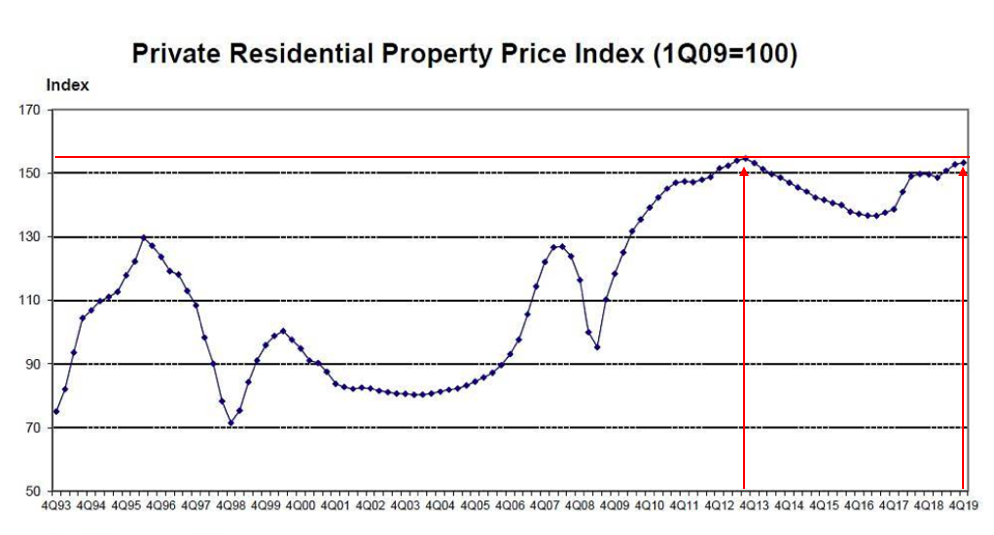

Let’s take a look at the Private Property Price Index Chart below.

From the chart above, you can see that the market in 2013 and 2019 is very similar, so what causes such a huge profit difference for those who sold in 2013 in those sold in 2019?

Let’s take a look at the Price Chart for The Estuary.

From this chart, we see that the price increased significantly in 2013, which is when the project TOP. However, after the TOP hype is over, you will see the price start coming down and remain stagnant from 2015 to 2020.

So, does it means that prices will always come down after TOP?

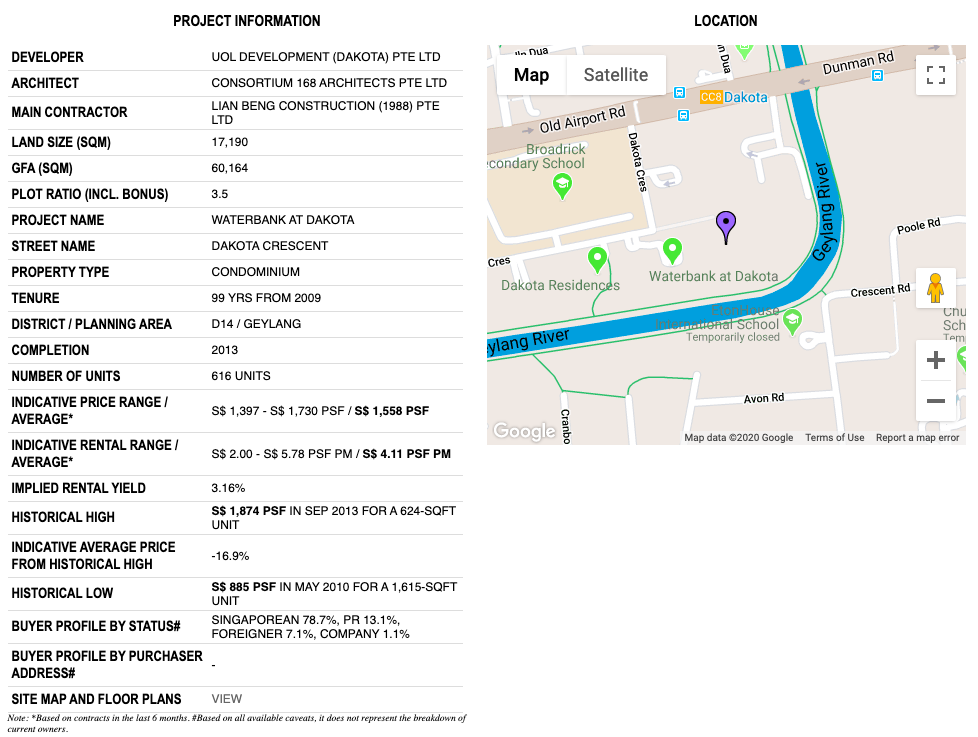

We will take a look at another project, Waterbank At Dakota which also TOP in 2013, also launched around 2010.

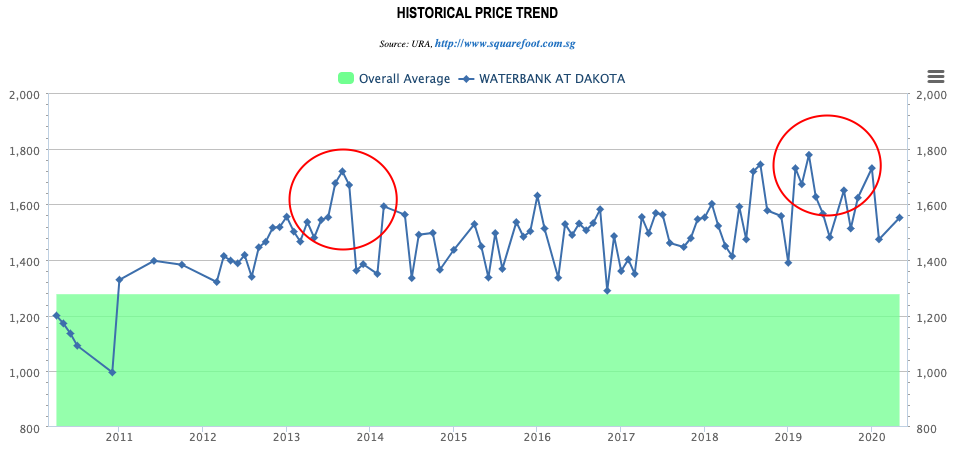

If you look at the price chart of Waterbank at Dakota, you will notice that the price also increased significantly at TOP.

However, the difference is that after TOP period, the prices of Waterbank dips a little but after that continue to appreciate over the years, and in 2019, you will see that the property price has surpass the peak at TOP.

What I wanted to highlight is this. YOUR INVESTMENT HORIZON MUST BE ALIGN WITH YOUR EXIT POINT. Example, if you intend to hold the property for 10 years, you cannot rely on the upswing at TOP, we need to look beyond that. The property you intend to buy needs to have more exit points.

In the case of Waterbank At Dakota, there is a lot more exit point other than TOP. Here’s a list of potential exit strategy for Waterbank.

- Prices typically goes up at TOP.

- Transformation of Geylang in Masterplan.

- Transformation of Paya Lebar into a Business and learning Hub.

- Completion of Kallang Wave and Sports Hub.

All these exit points ensures that the property continues to grow after TOP. Of course there could be more reasons why Waterbank prices continue to goes up.

What we see clearly is this, if you do intend to hold the property for a longer period beyond TOP, you need to have more EXIT STRATEGY and EXIT POINT.

Buyers paying Additional Buyer Stamp Duty really need to take note of this as you may have to hold and rent out for a longer period to have significant profit.

Thank you so much for reading this article, I hope you can see a clearer picture on how you should go about your next purchase.

If you are not very certain that you are doing it right and would like me to help you take a look, please feel free to give me a call.

Alternatively I can also work out a customized proposal with you.

There is no fees chargeable for consultation/ discussion.

Property investment is never an easy decision because a lot of factors have to be considered.

Both financial & non-financial factors.

Being in the industry for 11 years, I’ve been blessed with the skills, knowledge and experience to help people around me with regards to their property.

If you are planning to do something and wants a second opinion – feel free to let me take a look at it.

We can have a detailed no-obligation discussion based on your objectives, risk tolerance and financial position.

Drop me a WhatsApp message at wa.me/6598801790