In this article, I would like to share why would my client go for a 28 years old, freehold property.

Recently, I managed to transact and completed the sales of a unit in The Waterside, located in the East Coast vicinity. A buyer I knew for many years called me up and mentioned that he is looking for a property in East Coast. After sourcing around for him, I shortlisted this unit which he took a look with his family, offered and closed the deal within the same day.

Am I trying to say that a freehold property is always a better choice? Not really.

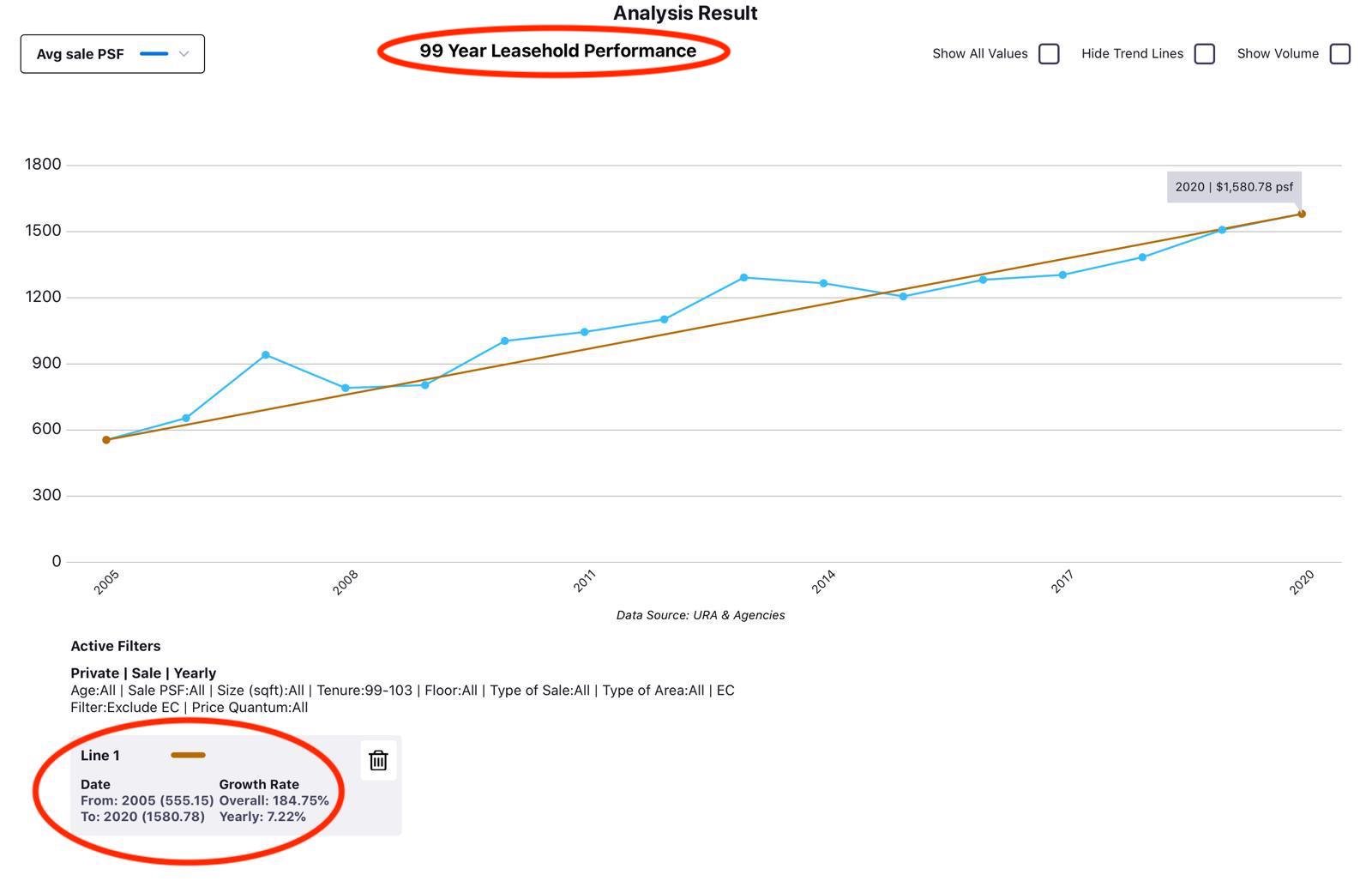

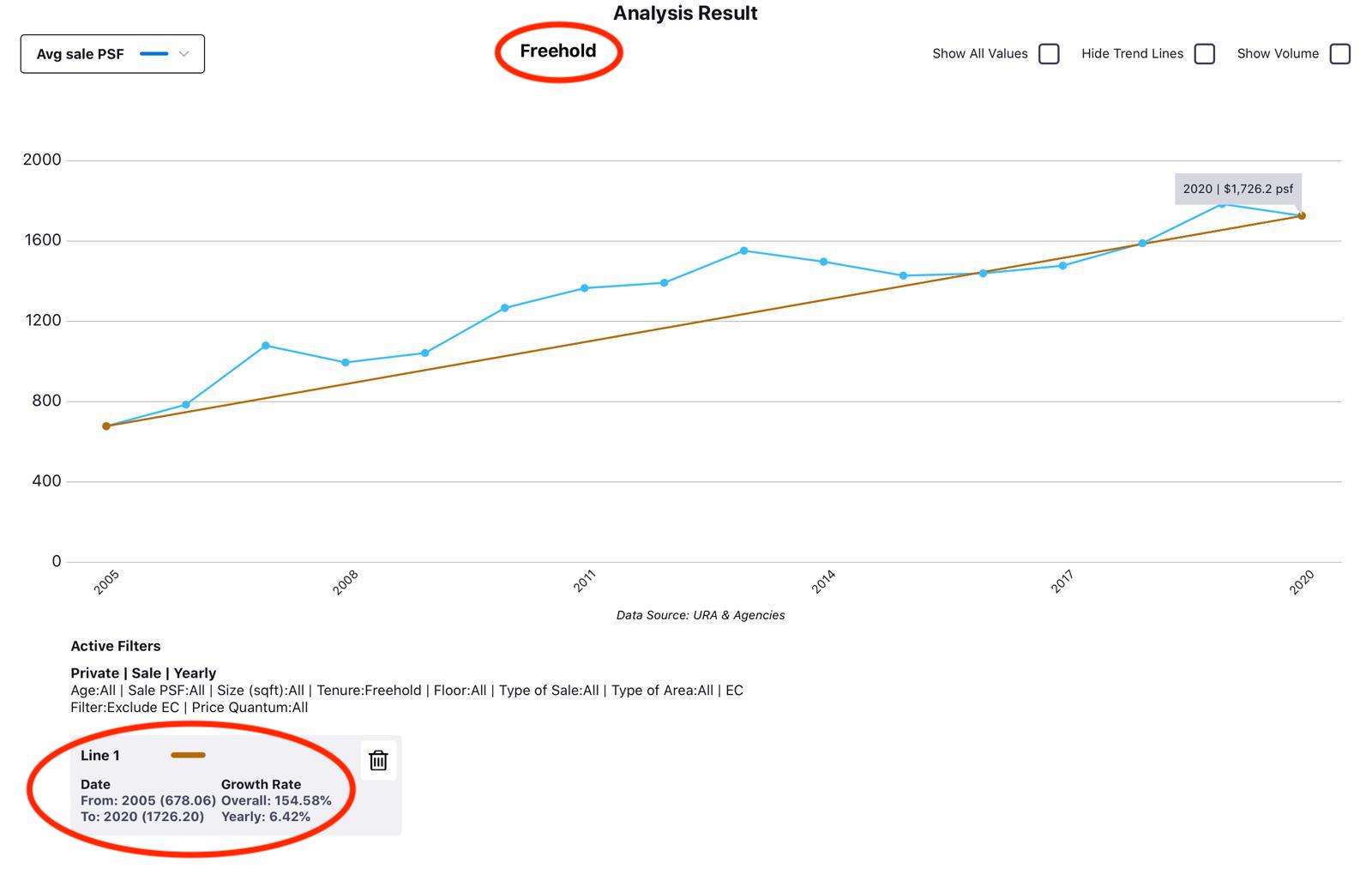

If you look at the below charts, the price of leasehold property actually increase by 184.78% from 2005 while the price of freehold property actually increase by 154.58%.

Why is my buyer so convinced about this project even in such an uncertain period? Why would a 28 year old property be so interesting? I thought many agents were saying that there is no difference between freehold and leasehold?

Let me share with you the research I have done.

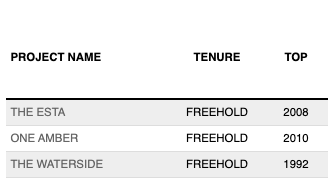

Here’s some basic information about Waterside

- Located along Tanjong Rhu Road.

- Land area of approximately 48,000 sq. m, only 502 units across 6 blocks.

- About 16% of the land area are built up area, with expansive grass lawn and gardens.

- Unit size is between 2100 sqft and 2500 sqft, single level.

- Most units offer sea views, views of the Kallang Basin, Marina vicinity and city view.

- Completed in 1992

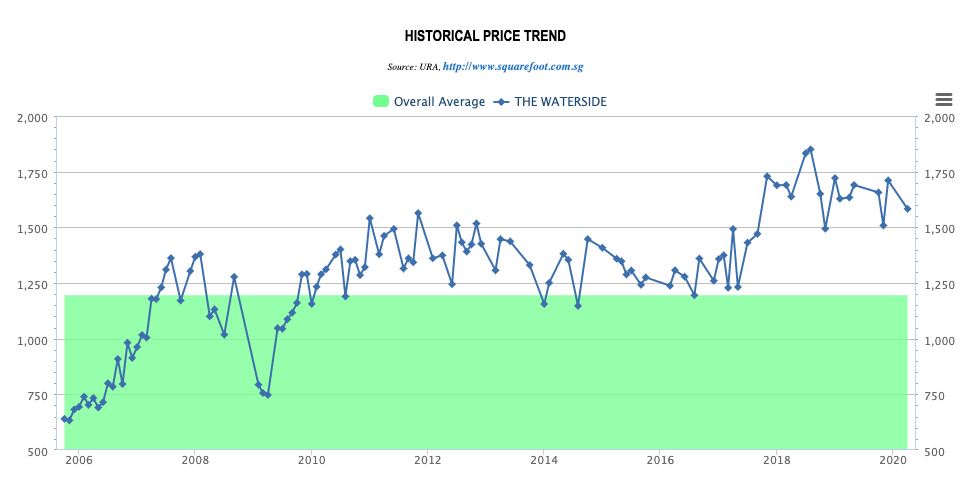

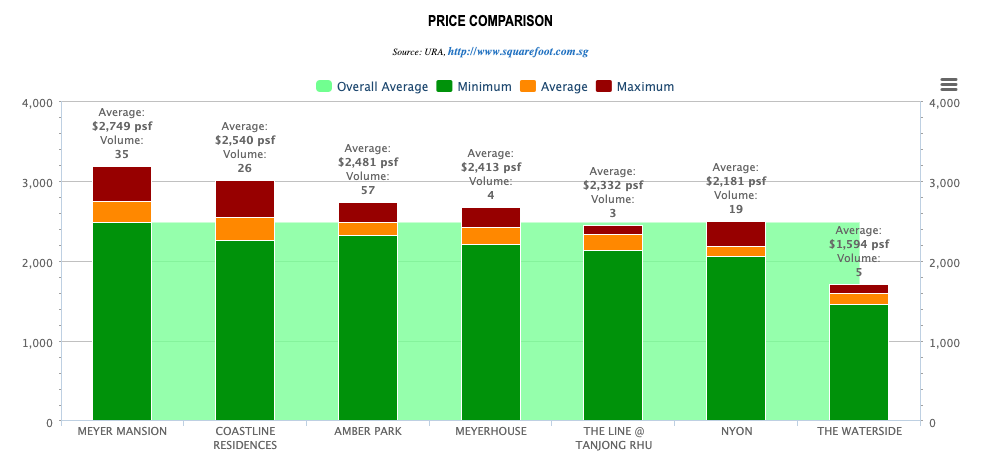

Transacted prices(psf) for The Waterside is at an average of $1594psf for a past 12 months period.

Prices ranges between $3.34mil for a low floor 2142sqft, to $4.15mil for a high floor 2411sqft.

If you look at the performance of the property, you will noticed that it has came down from a peak of 1850psf done in 2018 August. It is also transacting at almost $$350psf above the average $1250psf for the period between 2016 and 2018.

While it looks like the price has came down, it is still significantly higher than between 2016 to 2018. It is also higher than the peak in 2012.

Is it still a good buy since prices has gone up significantly in 2018?

Let’s look at the price of The Waterside in comparison with some of the freehold new launches around the vicinity.

If we compare to the highest of the lot, Meyer Mansion (land size: 7919sqm), there is an average psf difference of $1155psf. If we compare to the lowest of the lot, Nyon (land size: 2117sqm), the average psf difference is $587psf. The Waterside land size is 48,000sqm.

You may have heard people telling you that freehold or lease hold doesn’t matter…..

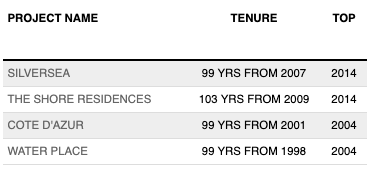

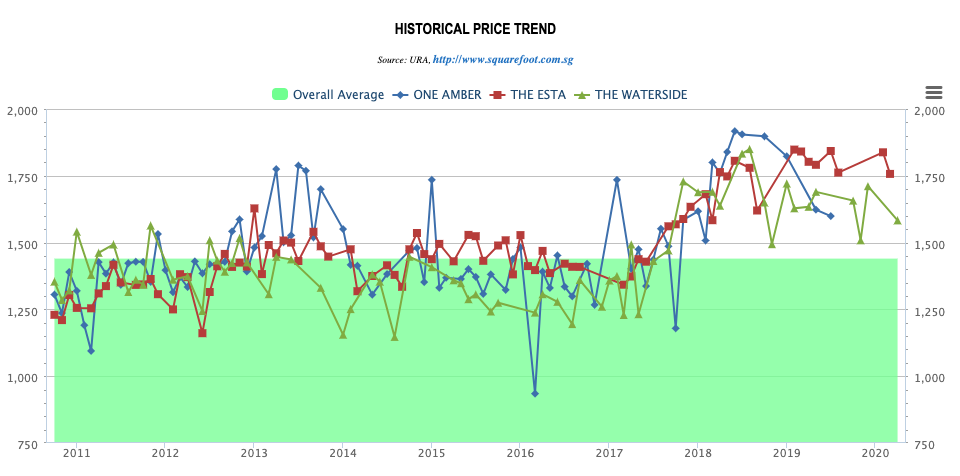

Let’s take a look at some of the more popular freehold and leasehold property in the vicinity. I have look into a lot more projects in this area but will only show this few so as not to clutter the comparison chart.

You will notice in the chart above that the prices didn’t move much when the market runs in 2018. I have looked into a few more leasehold property in the district and discover similar trend.

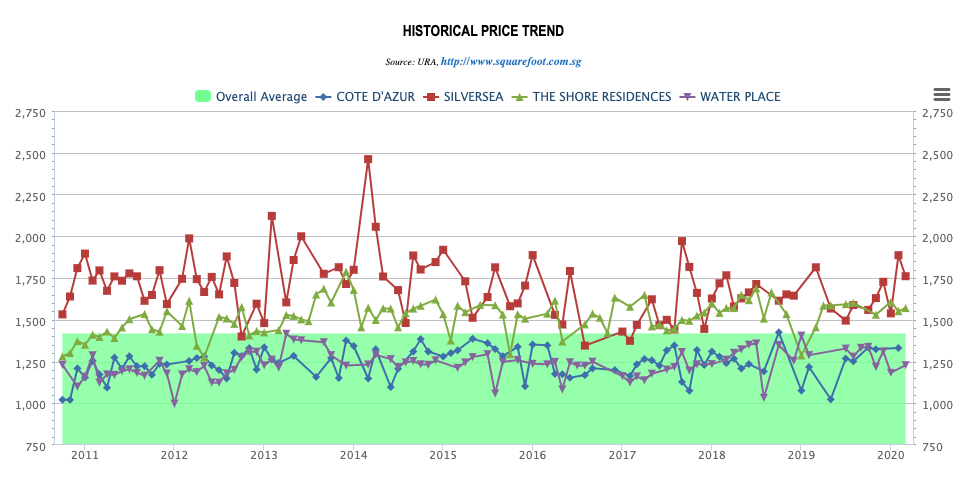

Now, how about the freehold?

If you look between 2017 to mid of 2018 you will notice a jump of almost $400psf to $500psf. Which is significantly more than the leasehold. Even for projects like One Amber and The Esta which are too young for en-bloc consideration.

So, we can see that despite the overall performance of leasehold property showing more growth, there are still locations where freehold properties has more capital gain potential.

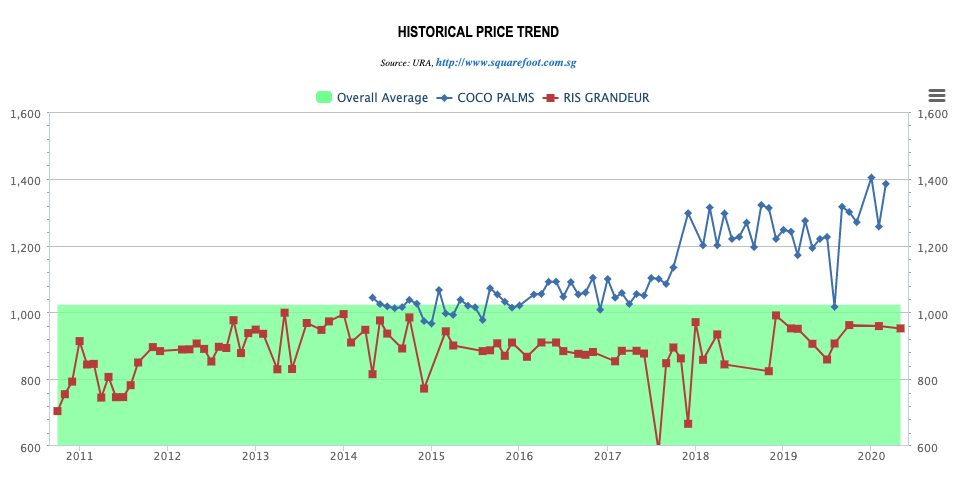

In case I gave the wrong impression that you should always go for freehold…NO! It really depend on location. Here’s an example where freehold has no advantage.

We take a look at Coco Palms (Leasehold) and Ris Grandeur (Freehold).

Here we see Coco Palms (leasehold) prices goes up significantly while Ris Grandeur (freehold) stagnated.

In my opinion, whether freehold or leasehold is a better choice will depend on a few factors. The demography of buyers buying in the area, the number of freehold properties in the vicinity plays a big part. If there is a lot of freehold property in the area and you are considering a leasehold, it is good that you do a more thorough research.

Of course there are more factors that will impact the profitability of your property. Holding period of the property is a consideration as well. In the case of Waterside, my client is taking a long term view on the investment. While it seems undervalue and has the potential for growth, it is also difficult to tell when it will happen.

Below are some picture of Waterside I have taken.

Hope you enjoy reading this short article.

If you have any particular questions you for me or would like to discuss about your property plans, you are most welcome to contact me and I will do my utmost to answer your question.

Being in the industry for 11 years, I’ve been blessed with the skills, knowledge and experience to help people around me with regards to their property.

If you are planning to do something and whats a second opinion – let me take a look at it.

We can have a detailed no-obligation discussion – based on your objectives, risk tolerance and financial position.

Drop me a WhatsApp message at wa.me/6598801790