The East Coast holds a special place in my heart.

Not just a as a real estate agent.

But this is the place where I built up a lot of memories in my younger life.

In my growing up years, I stayed in the Telok Kurau and Joo Chiat vicinity. My grandpa had a provision store along Guillemard Road and I spent a lot of times running around that area as a kid.

Being quite adventurous (my parents would call it naughty) I have gone down the steep slopes of Opera Estate on my BMX and skateboard.

I have also performed some “showy” stuns down the slides of Big Splash.

I also played at the huge playground at Parkway Parade Level 7.

And I have also brought a few female classmates to that famous Yellow Haunted House around Siglap to prove my bravery. I can still vividly remember that car in porch of the abandoned house that was already covered with weeds and plants.

So when I started my real estate business about 10 years ago, it was natural that I began in this area.

The East Coast Area is Part of District 15 In Singapore

Singapore property is divided into 3 regions.

There are:

- Core Central Region (CCR)

- Rest of Central Region (RCR)

- Outside of Central Region (OCR)

If you look at the map, District 15 is located just outside the Core Central Region (CCR).

In fact, it is considered an RCR area – Rest of Central Region.

Why all these labelling for a tiny country like Singapore?

Well, it is necessary as that area is considered the prime metropolitan area of Singapore.

CCR consists of District 9, 10, 11 and all the major commercial buildings aka the Central Business District (CBD) area.

The CCR area is also where the most expensive residential properties in Singapore are located.

The RCR area is where properties are the next most expensive due to its proximity to the CCR area.

RCR is not top tier but it is at least where mid-tier properties are located.

And the OCR area is generally everywhere else.

So in the overall big picture, you can see there is a hierarchy in how Singapore residential properties are classified.

CCR is creme de la creme – the best of its kind.

RCR is second best.

OCR is basically the bronze medal.

You can see this being indirectly acknowledged when HDB launched the Prime Location Housing (PLH) model.

The first build-to-order (BTO) HDB flats on the Keppel Club site, which are expected to be highly sought after, are…

Posted by The Business Times on Tuesday, April 12, 2022

PLH HDB units are located near the city centre and Greater Southern Waterfront – which is basically in the RCR area.

It basically creates a category of HDB units which are more “special” than the rest.

In fact, it is so special – it requires a 10 year Minimum Occupation Period and a clawback of subsidies once the HDB is sold.

So if I were to give a simplified analogy on how the prices are stacked against one another using smartphone brands…

CCR is where you can expect the prices of the latest iPhone models.

RCR is where you can expect the prices of the latest Samsung models.

OCR is where you can expect the prices of Oppo models.

It is not the best analogy but I hope you get the understanding of how the prices work in these areas.

The Most Popular New Launches In East Coast Area

The East Coast being part of the RCR area is a very popular location.

It is much easier to get to the CBD from there when compared to other locations in the RCR area.

Below is the list of new launch developments that are most popular in the East Coast area.

It is based on the volume transacted in the last 6 months.

Let’s compare that to the list below of condo developments in the resale market.

They are sorted based on volume of transactions in the last 6 months.

I am highlighting the maximum price as they are usually the most recent prices in the trend of the rising market we are in right now.

As you can see – some of the resale prices are already quite close to the new launch prices in the district because of the recent increases in the resale market.

But that’s not all.

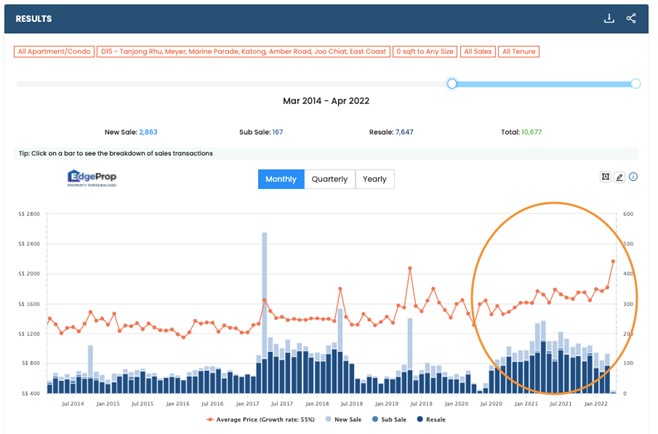

From this chart, you can see that the prices of D15 properties in fact did went up pretty sharply since 2020.

So what does this mean?

It means District 15 properties including East Coast properties – their resale prices are climbing upwards to a new peak.

Here I share 2 ways you can take advantage of this trend.

#1. Switching from D15 Leasehold to D15 Freehold

I understand some D15 owners have a strong attachment to their location.

I have met my fair share of East Coast owners who love this area so much that making a move to another location becomes very hard.

So for these owners, I advise making the switch from leasehold to freehold developments – but within the same area.

Since your leasehold East Coast property have enjoyed tremendous growth recently, perhaps it is time to lock-in those gains and make the switch to freehold instead?

Let’s explore an example.

An owner at the 99-year leasehold Cote D’Azur (highest transacted recently at $1877psf) can consider to switch to a freehold development below:

- One Amber (highest transacted recently at 2000psf) or

- Seafront at Meyer (highest done recently at $2181psf)

You can see the gap in prices between leasehold and freehold in the East Coast areas becoming smaller.

The 99-leasehold properties in D15 seems to be catching up to the prices of the D15 freehold properties.

For owners who are holding their leasehold properties for enbloc, they can enhance their position by switching to Makena which is a big freehold plot – the highest done at $1804psf with a Meyer Road address.

So you get the advantage of living within the same area and yet enhance your property gains.

#2. Switching from D15 Freehold to D9 Property

How about owners who are holding on to a freehold projects that has already appreciated?

One of the trend that I have observed is that the prices of some of the properties in D15 are catching up with that in District 9 as shown in the below chart.

This means the gap between RCR and OCR regions is becoming smaller and smaller.

You can see this in the price trend of new launches in District 9.

Below are the top new launch projects in District 9 – in terms of volume over the past 6 months.

You can compare the prices to the already completed projects in District 9 below:

It is interesting to note that D9 projects like:

- The Imperial

- Visioncrest

- The Inspira

- The Quayside

- Waterscape at Cavenagh

has prices that are very close to developments in D15.

Observations on the Price Behavior of Properties In D9 vs D15

Here are some of my observations for East Coast properties and in general for District 15:

The price appreciation for the freehold properties in D15 has slowed down – because the prices are getting too close to that of D9 and probably some of D10 properties.

The gap between RCR and CCR regions is becoming smaller and the difference in their prices seems very marginal.

In the grand scheme of things, this means that properties in the RCR regions like D15 properties – they will hit a cap on their prices soon.

It is highly unlikely that RCR properties will hit prices that will surpass District 9 properties.

What we will probably see down the road is this:

The prices of D9 properties will have to move up first – before there is room for the D15 freehold properties to appreciate in the short-term.

This is the main reason why I see there is an opportunity for D15 freehold owners to make the switch to a D9 property – as there is a greater chance of price growth in the CCR area.

So, does it mean East Coast freehold owners need to get out of D15?

Of course not.

But if you been planning to enter the CCR area in order to be in the most prime location of Singapore – now is your chance to make the move.

Your freehold D15 price is at its highest possible price now.

RCR Means Being Caught In The Middle

RCR is a prime location in Singapore – there is no doubt about that.

The East Coast area is still highly prized and sought after.

I can understand if a lot of homeowners or investors there who wish to continue staying in that area.

It is a mature location with much nostalgia and lifestyle.

But making the comparison to D9,10 and 11 – we have to acknowledge that RCR is still second-tier.

And at this stage, I can see the growth of prices here will be capped – until the prices of CCR starts to move up again.

The reason why I can share all these is because the property market is and imperfect and inefficient.

That is when we can exploit and take advantage of these gaps when they show up.

What do I mean by these?

If we can take advantage of this characteristic effectively and use it to our benefit to grow our asset at a much faster pace.

And my job as a property agent is to research and look much deeper beneath the surface to identify such opportunities.

For example, a client of mine made approximately $600,000 paper gain purchasing a sea view high floor unit at the freehold Waterside development in 2020 for just $15xx psf.

Conclusion

I used the smartphone price analogy earlier on in this article because the reaction of buyers are quite similar.

I have brought buyers to view homes in D15.

I also have brought buyers to view homes in D9.

There is a strong resistance to pay beyond a certain amount for an East Coast home vs paying for a District 9 home.

Apple’s most high end smartphone model – the iPhone 13 Pro Max 512GB is priced at $2299.

Samsung’s latest smartphone model – the Samsung Ultra 5G 512GB is priced at $1998.

Notice the $2K price cap for Samsung while Apple on the other hand is willing to break that barrier.

Apple’s cash flow also makes the stock a safe haven during times of market uncertainty.

Posted by CNBC on Monday, January 3, 2022

There is a psychological resistance in price – and Apple being the only $3-trillion dollar smartphone company in the world – is able to get away with these type of prices.

Back in Dec 2021, I sold off a patio unit at the freehold Flamingo Valley in District 15 at near-record price.

It took me about 2 weeks of marketing to secure a buyer who was willing to pay the price we were asking for.

The seller is a client whom I got to know more than 10 years ago.

I marketed and helped to sell off their previous home for them as well.

They were one of earliest clients when I started my career in East Coast. And we have stayed in touch all these years.

This was one of the dozens of transactions I have done in this East Coast area since I started in real estate about 10 years ago.

But I was thinking, it could never hit this price 1-2 years ago had the market not moved up strongly in this location.

And at the point when I recommend that my client sell this property, prices of Flamingo Valley was almost on par with freehold properties in the Amber area.

So it was currently an ideal time for them to exist and switch to something of greater value.

Is making a move out of East Coast suitable for everyone? Not really.

It is really dependent on your own moves and whether you wish to move up the “property ladder” in Singapore – so to speak.

Every one of us comes from different financial backgrounds, risk appetite and with varying investment strategies in our horizon.

If you are keen to explore your options and choices available to secure a more improved property portfolio – let me know by dropping me a message via whatsapp.

All our discussions are no-obligation.