During CNY gatherings, I will always get asked this inevitable question: Are there still good lobang in the Singapore property market?

As an agent, my job is to always say Yes. ????

But to be fair, opportunities are getting limited currently.

There are a few reasons:

- Declining stock from developers. They are running out of units to sell.

- Cooling measures in December 2021 have caused developers to become more conservative in purchasing more land plots to increase their own stock.

- Gloomy sentiment due to potential tax increases

However, I also cannot say that making money and good returns from Singapore property is impossible.

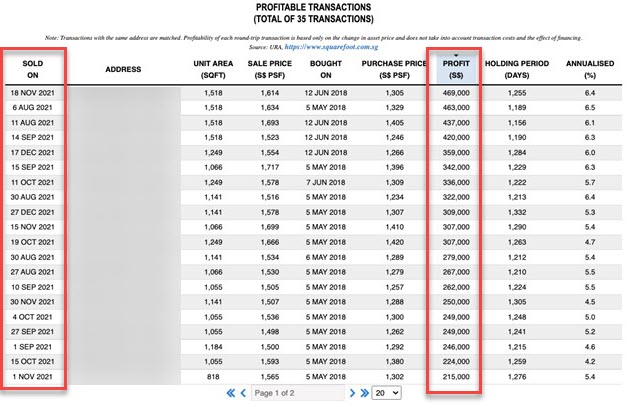

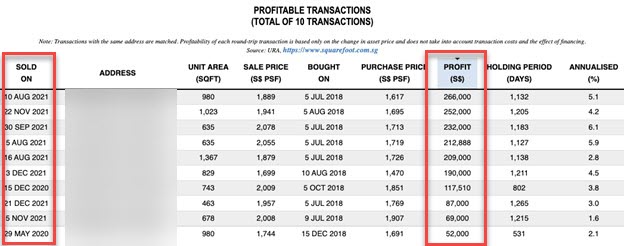

I’ve been coming across various transactions where many homeowners are still making very decent $200K-$400K profits – in spite of cooling measures.

And there are quite a few of them.

Most of them bought into the market back in 2018 and exited just as the 3-year Seller Stamp Duty period was up.

So are there still similar opportunities to consider right now in 2022?

Let’s explore.

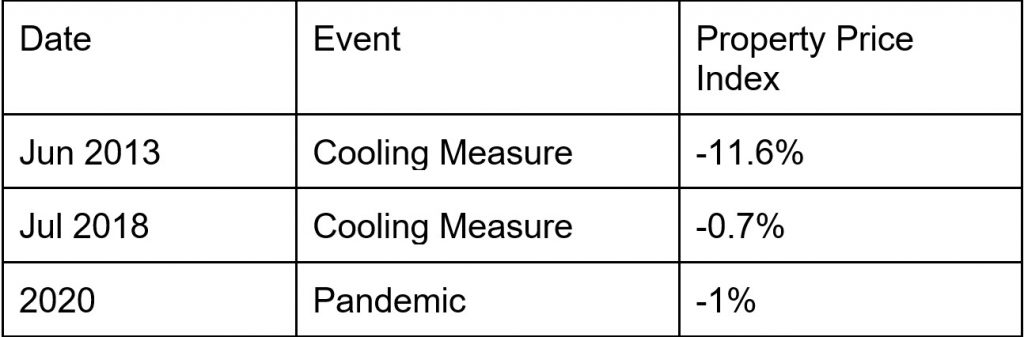

Factor #1: The Impact of Cooling Measures on Singapore’s Property Prices

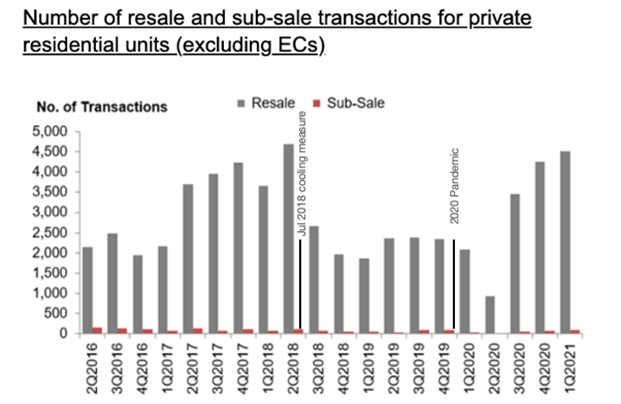

If you were to take a look at this chart below, you will see that transaction volumes drop drastically following previous cooling measures and pandemic crisis.

The last set of cooling measures was applied in July 2018.

One

One

This shouldn’t be very surprising as many will adopt the wait and see attitude.

While transaction volumes may drop, it also does not mean that homeowners are in a hurry to sell.

Thanks to the various restrictions on TDSR, most homeowners and investors have no issues paying their monthly mortgage.

These resulted in private property prices taking just a relatively small dip.

However, people will get tired of waiting to buy.

So once demand picks up, that will result in prices being pushed up eventually.

Factor #2: The Rising Numbers of HDB Upgraders

As an agent, I’ve always encountered this question:

Are there really so many buyers in the property market? Even when property prices are increasing?

The answer is Yes.

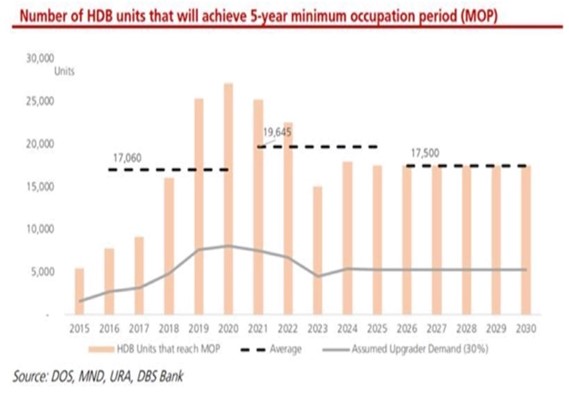

One of the main group of buyers is the HDB upgraders.

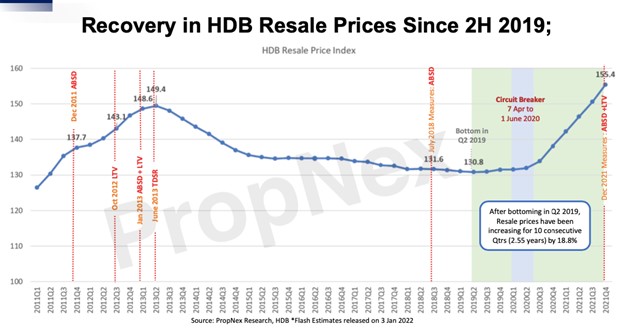

With the record numbers of HDB going MOP and the HDB prices at an all time high…

Many of them are taking advantage of the high HDB prices to upgrade to a private condo.

Even though they may be spooked by the cooling measures for now, they will eventually proceed with their upgrading plan.

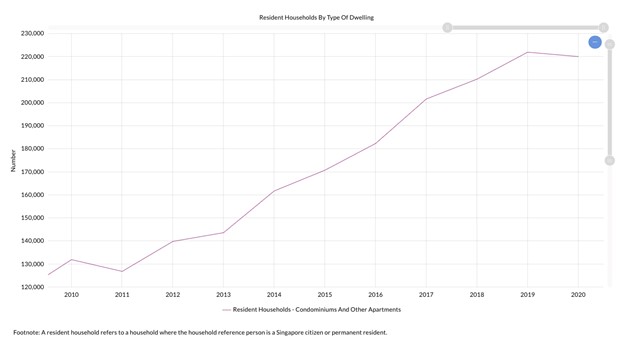

This chart below shows the number of resident households staying in condominium and apartments (excluding HDBs & landed).

Since 2010, it is increasing by approximately 10,000 units a year.

This chart does not take foreigners residing in Singapore into consideration.

All this is a reminder of Singaporeans’ strong desire to upgrade to private properties.

The dream of owning and staying in a private condo is now within reach for a lot of people.

Factor #3: Entry Prices of Future New Launches

For those who bought in 2018 and exited in 2021 with good returns – a main contributing factor for their success was their entry price.

The cooling measures of July 2018 forced developers to hold back from launching their units at high profit margins.

So in order to encourage more sales back then, they sold at very slim margins which meant that buyers bought at very “advantageous” prices.

Will we see another similar opportunity currently for the upcoming new launches in 2022?

I am not sure. It really depends on the developers’ appetite.

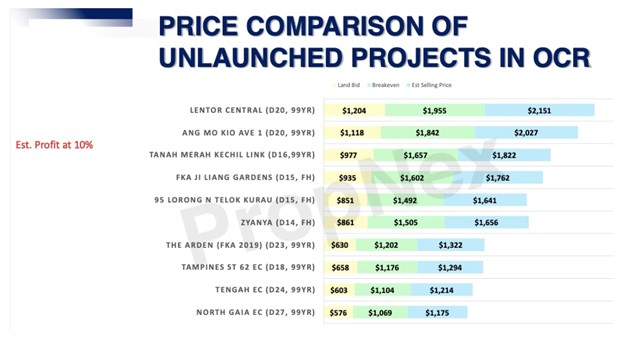

Here are the potential entry prices for projects to be launched in Outside Central Region (OCR):

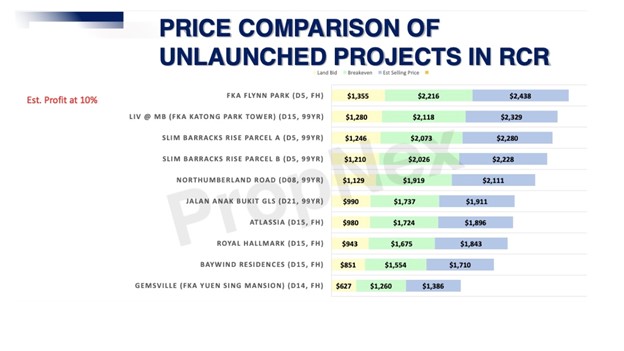

Here are the potential entry prices for projects to be launched in Rest of Central Region (RCR):

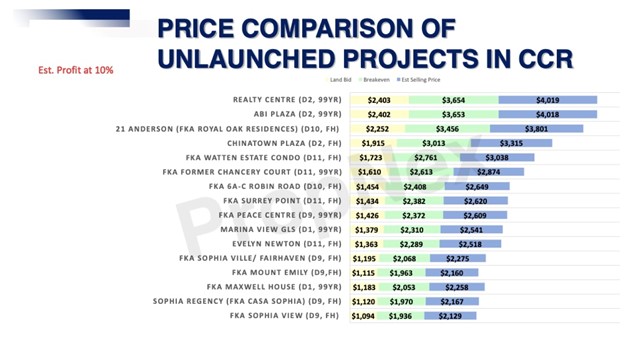

Here are the potential entry prices for projects to be launched in Core Central Region (CCR):

The yellow number is the land price, the green number is the developers’ breakeven price and the blue number is the estimated launch price.

If you study the numbers, it will give you a rough idea on how much a unit will cost there.

And in 2022 – it is time for buyers to decide whether entering the property market and parking significant amount of monies there is a good idea.

With inflation poised to continue to rise, it is good if your property prices rises in tandem.

At least you are protected from the eroding value of money – which is what will happen if you continue to keep those monies in the bank.

Would you rather your money grew by 10% in an appreciating asset or eroded 10% by doing nothing?

Conclusion

The property market moves in cycles. So is the market in 2022 similar to 2018?

In 2018, what led to the cooling measures being applied was the rising enbloc fever.

Developers were snapping up various old condo developments and that fueled the excitement in the market.

In 2021, what led to the cooling measures seem to be rising property prices caused by the pandemic.

Supply is short due to construction delays while demand is high due to people wanting bigger homes.

The conditions are quite different.

But what was clear – both situations were serious enough to warrant the government to step in with measures to cool down the prices.

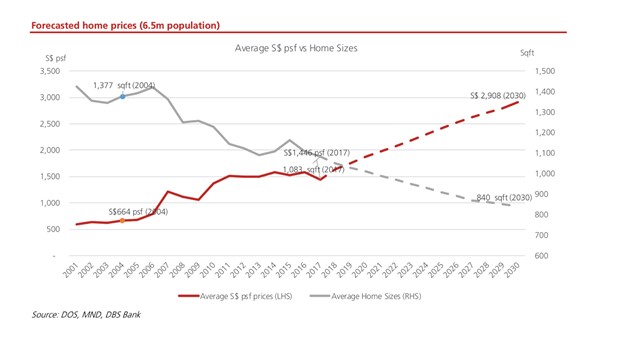

In 2018, DBS released a report with a prediction of housing prices in 2030.

That was almost 4 years ago.

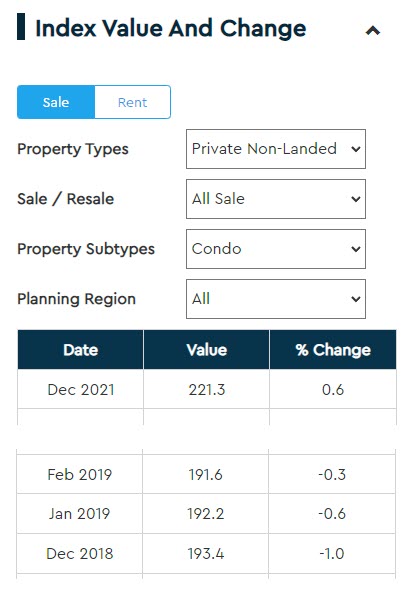

In Dec 2018, the private property price index was 193.4.

The average psf was $1500 psf.

In Dec 2021, the private property price index was 221.3.

So you can calculate the average psf is now about $1716 psf.

You can check it out at https://www.srx.com.sg/price-index

The prediction was private property prices could cost an average of $2900 psf by 2030.

Below was the chart they included inside the report.

Are we approaching there soon?

Perhaps. Only time will tell.

If you are planning to take action this year, I really recommend you to sit down and explore all your options.

While property prices might rise, it is never a sure-win thing.

Because in the end, a property can be an emotional purchase and exiting from it might not always be so straightforward.

What you plan to buy might not always be what people wish to buy from you in the future.

Have questions? I invite you to contact me for a no-obligation discussion to explore your choices.