2022 comes in after we approach almost 2 years into a pandemic with significant changes happening in the way we work and live.

As we start to embrace things like Zoom, WFH (work from home) and HBL (home-based learning), we are feeling the effects of this disruption.

For me, I have scanned the property environment for awhile thanks to my 11 years of experience and being active on the ground talking to buyers and sellers, investors and homeowners as well as tenants and fellow agents.

Here I came up with a list of 5 evergreen factors you should never ignore as you monitor and analyze your own property portfolio.

#1: Consider the government’s goals

Like it or not, you have to keep this in mind as you make decisions on selling or buying your property.

On the night of 15 December 2021, the latest cooling measures were applied and scheduled to come into effect on midnight.

There were already plenty of warning signs that has been released.

Some warning signs were highlighted as early as June 2021.

In Singapore, the government uses various tools to help with the property market.

Cooling measures are typically applied and the one we commonly hear about.

But at the same time, the government also has other tools as its disposal to help the market readjust.

For instance, back in 2017 – the Seller Stamp Duty was shortened from 4 years to 3 years.

It was called an “ease in the cooling measures”.

And just a few months ago, a 10-year MOP was introduced for the Prime Location Housing (PLH) model.

At the same time, owners who sell off their PLH HDB units will need to be prepared to return a portion of the proceeds back HDB.

With 80% of Singaporeans living in HDB flats, the HDB will remain the cornerstone of government’s housing polices.

And the space for you to “play” when considering for further growth – will be in the private property segment.

All these points to a government that is pushing towards this vision when they announced the most recent cooling measures:

“The measures undertaken in this cooling package will help promote a stable and sustainable property market.

The Government remains vigilant to the risk of a sustained increase in prices relative to income trends.”

Policies like ABSD which was implemented since 2011 and remained for the past 10 years – are good reminders about how strongly the government discourages multiple property ownership.

Remember this well so you do not fight a losing battle and start to lose money unknowingly.

Don’t fight the tide.

#2: Consider your breakeven point

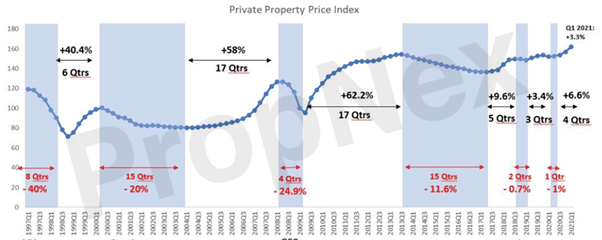

Breakeven is an interesting concept for you to consider. To understand this, you will need to take a look at how the Singapore property performed in the last 15 years.

Let’s explore the historical trends:

- During the Asian Financial Crisis in 1997, the market came down by 40%. This downcycle lasted approximately 8 quarters (3.5 years)

- For the Dot Com bubble in 2001, the market came down by 20%. But the down cycle lasted 15 quarters (almost 6 years)

- During the GFC in 2008, the prices came down 24.9%. The downcycle lasted for 4 quarters (1 year)

- Cooling measures (2014) the prices came down by 11.6%. The downcycle lasted for 15 quarters.

- Cooling measures (2018) the prices came down by 0.7%. The downcycle lasted 2 quarters.

- Covid-19 Pandemic (early 2020), the prices came down by 1%. It lasted only for 1 quarter.

Why did the pandemic only bring down prices by 1% and only for 1 quarter?

Here are some answers:

- the market is now better protected from speculation thanks to past cooling measures

- home owners are also better borrowers thanks to loan restrictions like TDSR and MSR

- pent-up demand for bigger space due to WFH trends

- record number of HDB upgraders

I remembered there were some buyers who thought they could purchase at “fire sales” prices during the height of the lockdown and circuit-breaker period.

But it turns out many home owners have plenty of holding power and prices didn’t drop much at all.

In fact, it turned out that in 2020 – in the uncertainty of the pandemic – were really the best time to buy as prices have now (2021) risen faster than buyers have anticipated.

If you were to explore the breakeven point of Singapore property at different times in the past 20+ years, you can refer to these numbers:

- If you bought at the peak in 1997, you will need to hold till 2008 to reach the same price. This means a breakeven point of about 10 years.

- If you bought in 2000, your breakeven point will be in 2007. That means about 7 years to breakeven.

- If you bought in 2008, the breakeven point will be in 2010. That is only 2 years to break even! Hence why punitive cooling measures were introduced in 2011.

- If you bought in 2013, the breakeven is in 2020. 2021 is a great time to sell – you might actually even make profits.

The worse case scenario will be 1997 – having to hold for 10 years to just breakeven.

But our financial markets has since has become more mature and complex – and is more able to withstand and recover from crisis.

So let’s consider the next worse-case scenario – 7 years to hold in order to breakeven.

If the market falls by 25%, and your downpayment is 25%…

To make it worse – you just started paying the installments…

There should not be any risk of the bank asking you for top-up – as long as you are ABLE TO SERVICE the loan.

In the worst case scenario, let’s say we are prepared to hold a property for 7 years.

So chances of having to sell when the market is down is actually quite limited. There is always room for recovery.

In my research and observations – most of the properties whose prices went down and never quite recovered are usually the luxurious segment and the speculative market.

Why does it happen there?

My guess is for really wealthy owners – they are willing to stomach losses once they lose interest in the property.

And they do not always hold up the prices in favour of a quick exit.

A 7-digit loss is a small drop in the bucket for this group of investors.

The speculative market attracts mainly investors who are willing to move on if something else looks more lucrative.

Most ordinary home owners will not dump their property when the market is bad so long they can afford to hold.

#3: Consider the significant impact of inflation

In the US, the inflation rose to its highest level since 1982 – hitting a high of 6.8% in November 2021.

It is one of the biggest reasons why we need to stay invested.

While cash is liquid, it is also the guaranteed way to lose the value of your money.

Singapore’s headline inflation rose to 3.2 per cent in October, the highest in over 8 years, according to consumer price index (CPI) data from the Monetary Authority of Singapore (MAS) and the Ministry of Trade and Industry (MTI) on Tuesday (Nov 23).

The last time headline inflation crossed the 3 per cent mark was in March 2013.

The increase, compared with 2.5 per cent in September, reflected stronger private transport and accommodation inflation, in addition to core inflation.

Even without the report, you might have observed that the prices of cars, properties and food has all gone up year-on-year.

Our money – if not carefully managed and hedged against inflation will lose its value.

When inflation hits, it also pulls up the prices of our property – making it that great hedge against inflation.

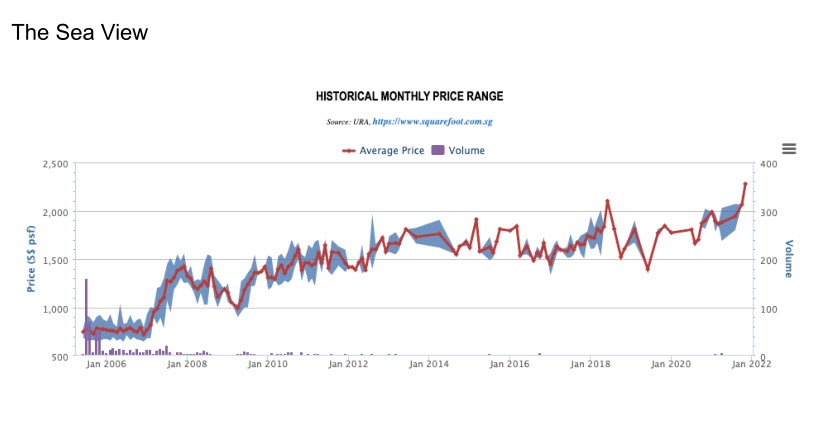

How does property perform in the long run?

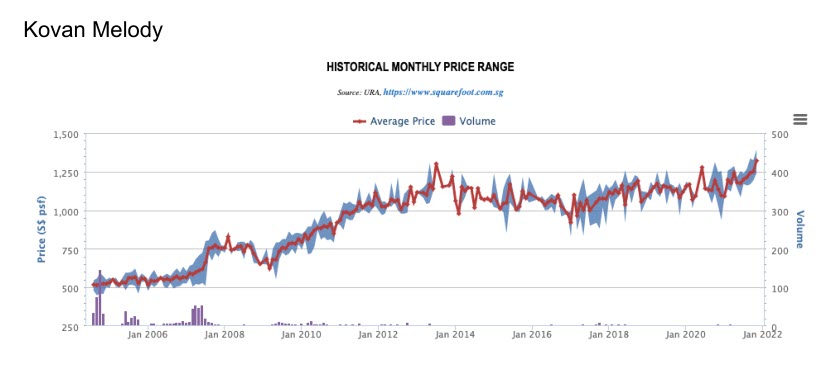

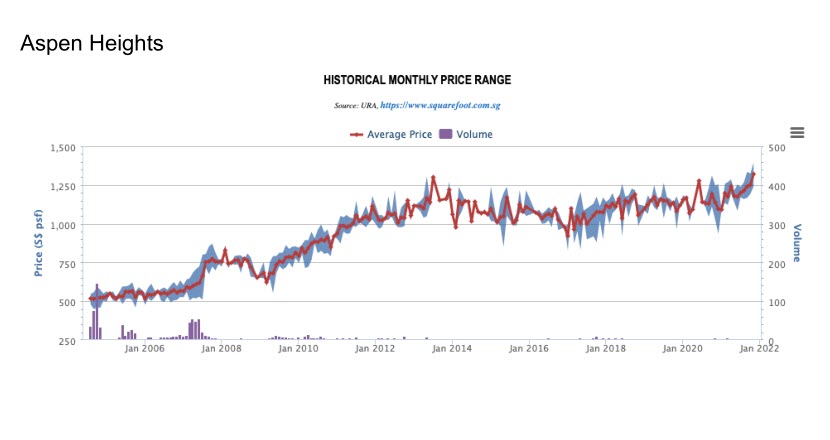

Let’s take a look at some of the popular projects:-

Some of you may have noticed that between 2013 to 2020 the prices seem quite stagnant.

This is due to the fact that the market is pretty muted because of the cooling measures as reflected in the resale price index.

For those who are concerned about stagnant prices, the alternatives is buying direct from developers.

However, I cannot say that all new launches can give the ROI that you want.

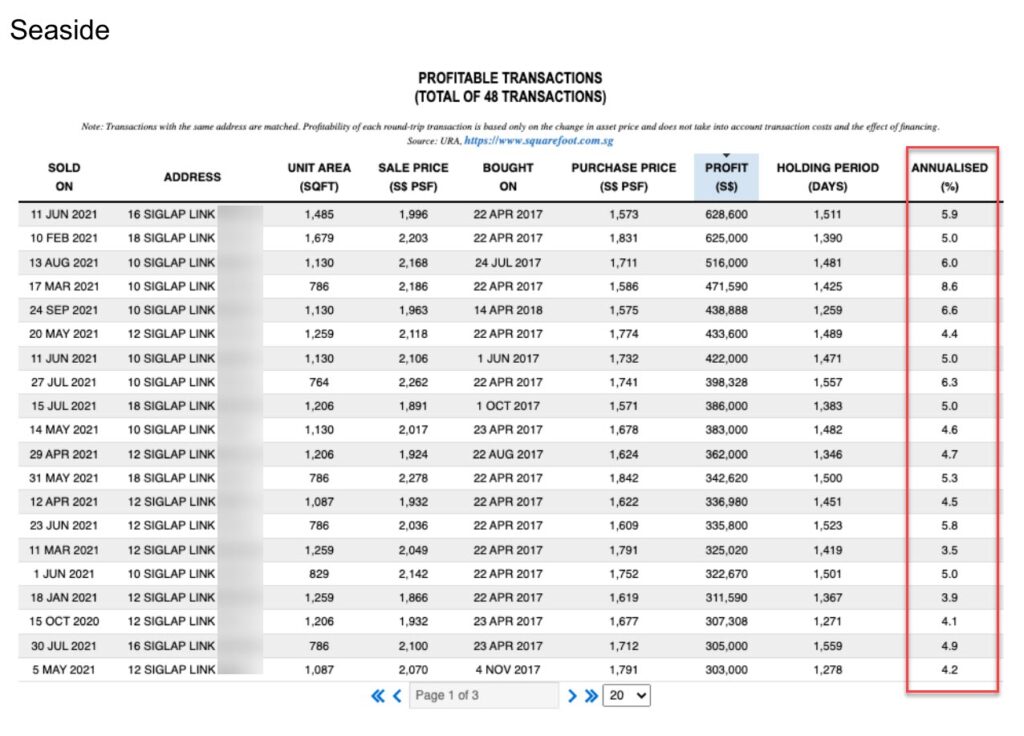

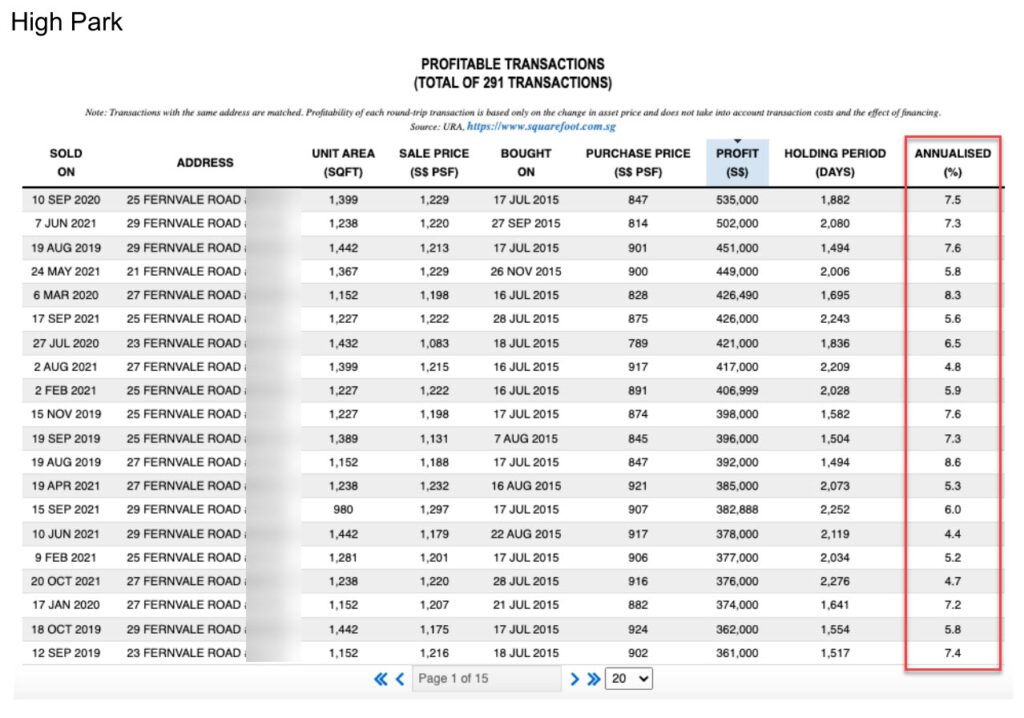

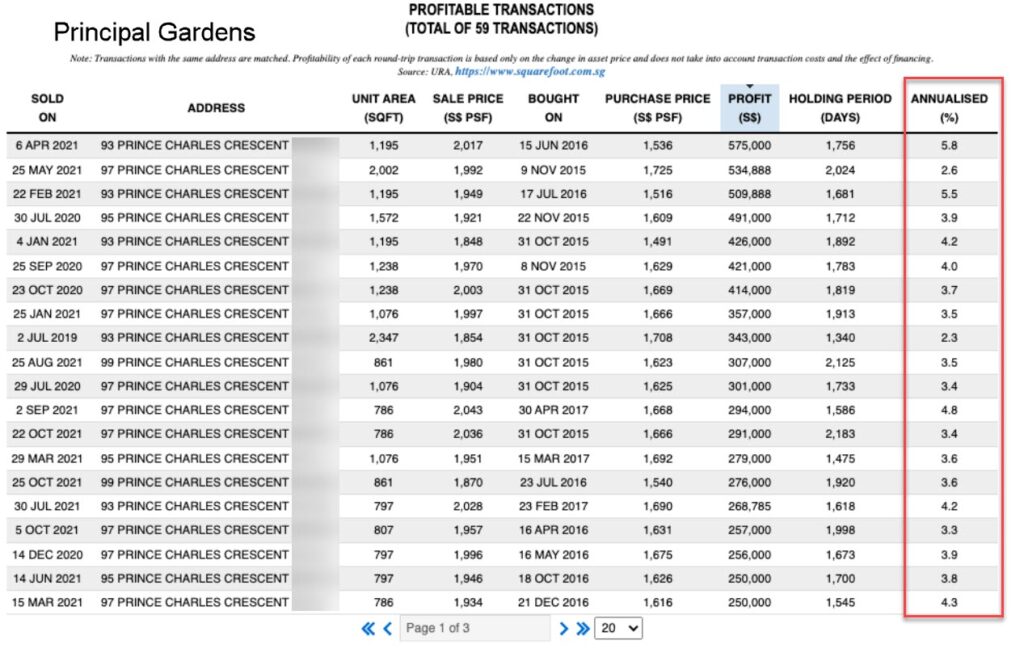

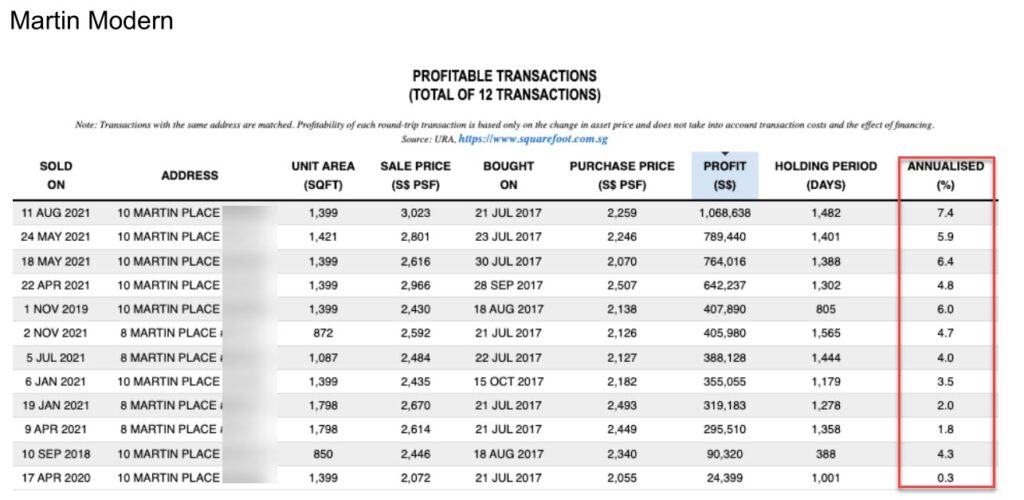

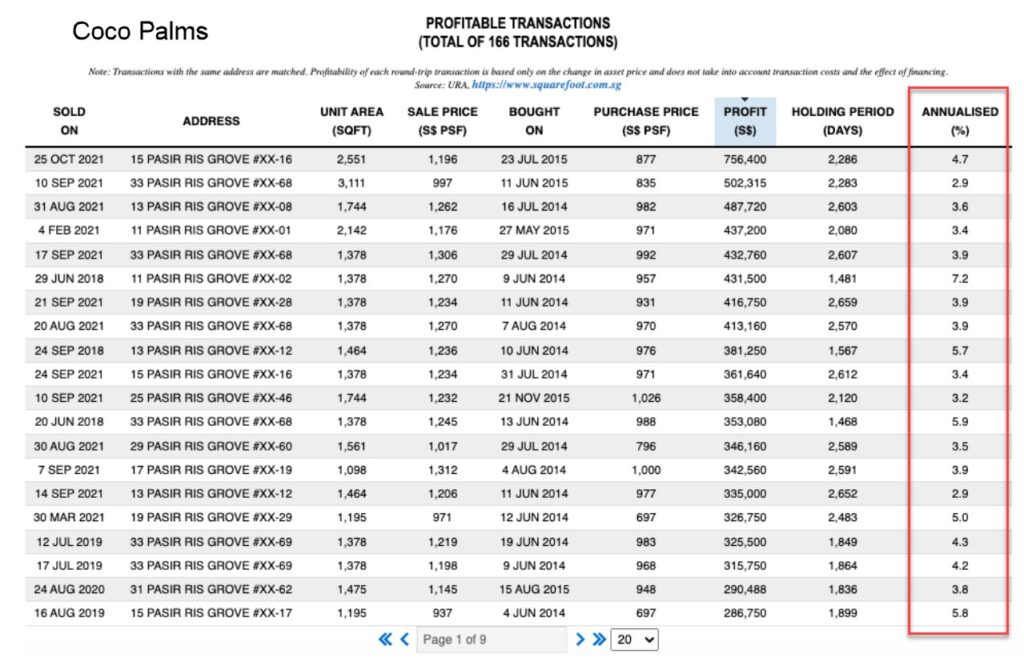

Below are some developments that provided solid returns for their first owners.

For some of these transactions, the annualized returns were as high as 7%.

And some of these owners exited after just 4-5 years.

That 7% returns can barely cover the estimated US inflation rate of 6.8%.

Of course, such returns do provide significant hedging against the the inflation rate in Singapore.

And it is possible from just making the right choice in your next home or property.

#4: For every success story, there are always the losses that are not shared

The truth is that for every profitable transaction, there are many other unprofitable transactions that happens in the market everyday.

Let’s not get carried away by the success stories.

I think it is better we are mentally prepared in the unfortunate event that your property is not appreciating and you need to hold for perhaps 10 years.

Let me share you a story about 2 different approaches to investment.

Approach A

Albert bought a property where the prices stayed stagnant for 10 years.

During this 10 years, he was careful with his spending because he very aware he needed to finance his mortgage.

He wasn’t too happy of course – especially when he saw how his other friends are making money so easily from property.

However, since he did not want to suffer a loss, he continue to hold the property.

He planned his finances properly and developed good spending habits to ensure he can pay the mortgage dutifully.

He also performs better at work as he knows that he needs his job to finance the property.

He still goes for holidays but plans more carefully in terms of accommodations and spending.

Careful is the name of the game.

Finally the day came.

After 10 years, his property finally appreciated as the market moved up.

He finally sold the property for $2M. He bought it at $1.8M.

However because of the monthly repayments he made, he has a sales proceed of $1M.

He has learnt to leverage on the property to cultivate very good spending habits and developed a very driven work attitude.

His children who monitors and mirrors what the father does – unconsciously picks up these values during their growing-up years.

Approach B

James took a very different route.

He has a fully paid property and is very skeptical towards property investment.

From time to time, he invested in some equity when he has spare cash.

He is more carefree with his spending. He rewards himself more frequently at nicer restaurants.

He also bought slightly better car for the family, afterall – he doesn’t have much financial commitments since his house has been fully paid.

While he is a good worker, he is not driven to be promoted as he felt there is no need to be so stressed.

Do take note, there is nothing wrong with both approaches. Both are valid and has its value.

It is a more on reflection on what are the priorities we have in life.

#5: Consider the meaning of financial security for you

Achieving financial independence and feeling financially secure are admittedly subjective assessments.

A nest egg of $200,000 may seem like a lot to some people but not to a high-income earner who is accustomed to spending $100,000+ annually.

For many people – the feeling of financial security isn’t simply a matter of how much money you have to your name. Numerous other factors may contribute to feeling secure financially.

In my experience as a property agent and advisor, I’ve also seen people for whom having a certain level of wealth to feel secure is a moving target.

And those targets tend to keep getting bigger and bigger over time once a given lower targeted amount has been achieved.

It is very common to see people who did well in their property purchase – make the decision to extract their gains and park it again into another property.

It develops their confidence level and they are eager for more success.

From HDB to a private condo to finally a landed property. It is a common path that I have seen numerous times in my years of experience in real estate.

Their vision gradually grows and that is how they make strategic decisions to grow their wealth.

What you focus on expands.

Conclusion

In the world that we live today, if you’re willing to work hard and seek to improve yourself and your work, over time you should be able to see your money grow.

The progress and advancement of technology and society generally increase the purchasing power of your money over time.

Yes, there are some people who lose sight of the differences between necessities and luxuries, especially in affluent and upper-middle class communities and circles.

We can always find people with bigger homes and more expensive cars who have taken more exotic vacations.

The bar can continually be set higher and higher in terms of how much money we “need”.

The continual improvement of products and services, particularly those that incorporate a lot of technology, leads to more people taking for granted how “luxurious” some of today’s choices are compared with those of the past.

Consider what’s happened with personal computers and smartphones.

Today, consumers buy smartphones that have many of the same functionalities and can access far more information than personal computers could a generation or two ago.

I am old enough to notice that today’s smartphones costs less than the cost of personal computers from a generation or two ago.

Today’s smartphones are like a handheld personal computer, a phone (that can easily travel with you), and a quality camera all rolled into one!

That’s how much the world has transformed in the palm of your hand.

To have any chance of success in life today, we need to accept a transformation in our own mindset.

Sometimes playing too safe can be the most riskiest option.

I welcome all questions.

If you are looking for someone to talk to and have some queries on your own property – whether its HDB or private – I invite you to contact me for a no-obligation consultation.

Drop me a whatsapp message or fill up the contact form.