Recently, I met with a young couple looking for a resale HDB. After following up with them for a while, they told me they will drop the idea of buying and will stay with their parents while they build up their savings.

Why? They were unable to pay the Cash Over Valuation for HDB and renovation.

Actually they are not alone.

It is very common for resale HDB to have COV component in a rising market.

Valuation is based on past transactions – so it cannot catch up with owner’s asking price in a rising market.

Therefore when a deal is closed at owner’s asking, a gap between valuation and selling price resulted.

That is why COV is needed – to top up the difference.

With construction delays arising especially for BTO flats, this is the reason why the HDB resale market is so active and moving.

So if you are one of those who are planning to enter the HDB resale market during such a tight supply situation like now – here are a few things you should be aware of.

#1: COV Is a High Upfront Cost That Might Be Hard To Recover From

If you ever visited Halloween Horror Nights at RWS during the pre-pandemic period, you will realize that they are 2 lanes to visit the Haunted Houses.

One lane is the normal lane. The queue is long and it takes 1-2 hours to enter the haunted house – depending on how popular the attraction is.

The other lane is the express lane. This lane is premium and allows you to jump the queue. You need not wait and you can enter the haunted house attraction earlier than everyone else.

But the express lane requires you to purchase express lane tickets that are very expensive and exorbitant.

You get the convenience, you get some comfort as you don’t have to squeeze with the crowds.

But there is a big hole in your pocket.

Similarly, paying COV is form of convenience. You get your home earlier than everyone else.

But you might also fall into the trap of overpaying for an old flat that might not be worth the price.

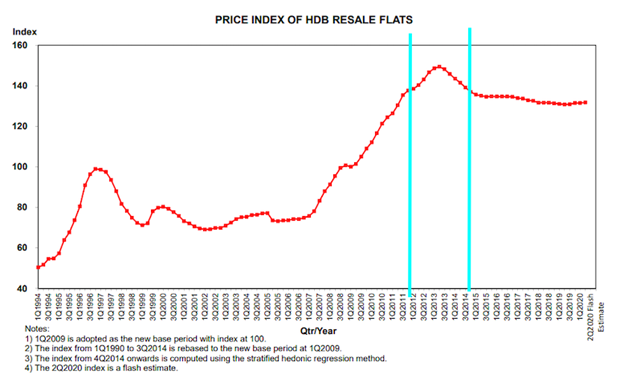

Historically, especially in the 2012 to 2014 period, many HDB buyers who paid COV have not been able to breakeven, even till now.

But what you need to be aware of is that beneath that convenience, a resale HDB may loses it’s value over time due to the lease decay of old HDB flats.

It is very common that you might not get back the COV you paid if you plan to sell the HDB flat in the future.

Those cases of $100K COV for a resale HDB flat? Those buyers are very likely cash-rich retiree buyers who were previous condo owners that cashed out.

They are likely to pay such big sums because they are planning to stay there for the rest of their lives.

#2: A Private Condo Can Just Be A Stepping Stone

I asked this same young couple whether were they open to understanding the financing of a private condo.

This is because based on their income and CPF contributions, they could actually afford a 2-bedder condo unit.

After understanding the situation of this particular couple, I realized that they were able to go for a 2 bedroom private resale condominium if they can set aside a small amount of cash from their pay every month.

Initially, they were pretty skeptical of the idea of a 2-bedder condo. No one wish to overcommit.

The other concern is the size as the family grows.

The concern about size is valid if they have been married for awhile and have children who are actively growing and needing space.

But for this case, they do not have any kids yet, and also children don’t grow overnight.

There are always upsizing opportunities down the road in the future.

In the future, when the family gets bigger:

- they can choose to upgrade to a 3-bedder private condo

- Or if they choose to, a resale HDB in future when the HDB market stabilizes.

After all, Seller Stamp Duty is only 3 years – and it starts the day you sign the sales agreement.

Compare this to having to wait for a delayed BTO to complete and adding on the 5-year MOP – it might take you 8-10 years before you are eligible to sell the HDB flat.

#3: Financing For A Private Condo Is Heavy But Not Impossible

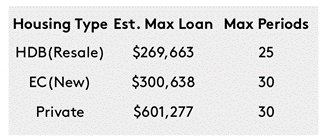

Here are the numbers that I went through with them:

For a 2-bedder condo at $800k;

- 5% Cash needed is $40k (which is almost similar to the COV they are looking at)

- Another 20% down payment, $160,000 can be from combined husband and wife CPF OA

- Stamp fee of $18,600 can also be from CPF (For a resale condo, this needs to be paid in cash)

- The couple will also take on a 75% loan, amounting to $600,000

- Assuming they can take a 30 years tenure

- They needed a minimum combined income of approximately $4500 to qualify for the loan (Subject to TDSR)

- Monthly mortgage installment at 1.1% interest is $1,957.52.

- CPF monthly contribution into OA can be used. Assuming they have a combined contribution of $1400 into their OA.

- This means they will have to come up with $500 a month for the monthly installment, which is $250 per person.

Here is something for all homeowners to take note of:

If you can qualify to take a loan of $269,663 of HDB loan – you can actually qualify for a loan of $601,277 for the purchase of a private property.

You will also enjoy a longer repayment period of 30 years for a private property versus 25 years for a HDB.

#4: A Private Condo Might Be More Worthy In The Long Run

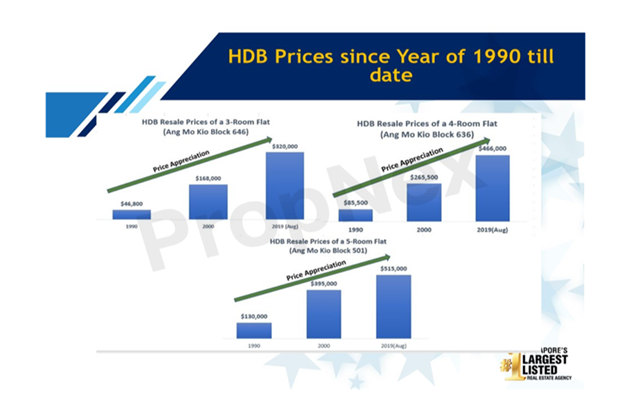

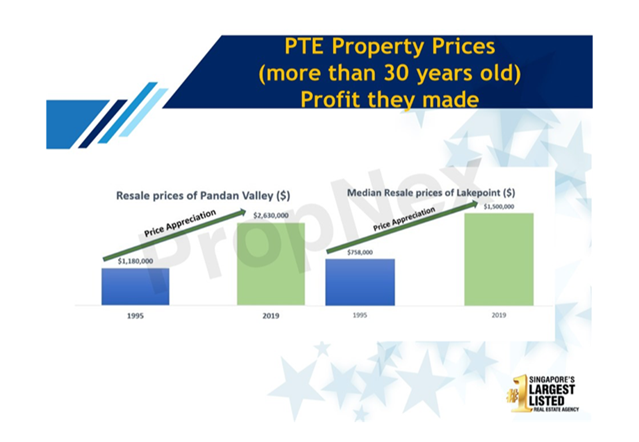

Let’s explore the prices of HDB vs Private Properties.

You will probably notice that private condo appreciated more over a 10 years period.

Here’s some fundamental reasons:

- The HDB prices has to be kept affordable for all Singaporeans

- The pool of buyers for HDB resale market are limited to Singaporeans and PRs. So there will be a ceiling price where they become resistant to buy.

- Aging leasehold condos have the option to be sold via enbloc or a collective sale process to developers.

- Aging HDB flats have the option of SERS or VERS.

- SERS is limited to only 4% of HDB developments while VERS is still a relatively unknown.

If you are already going to park a significant amount of monies inside your property or future home, then it is best that you park it in a property that can provide some returns.

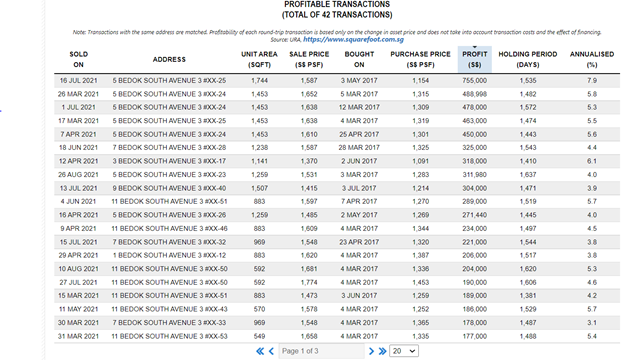

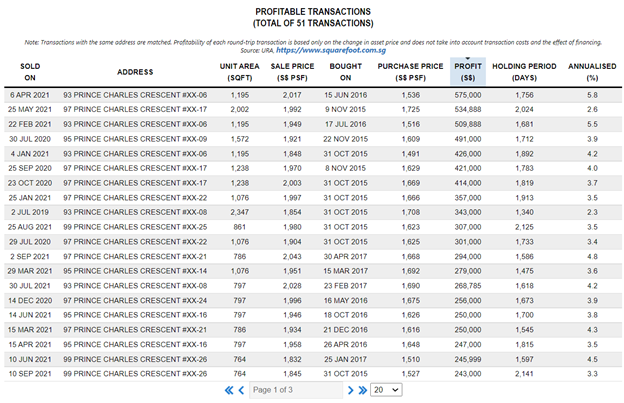

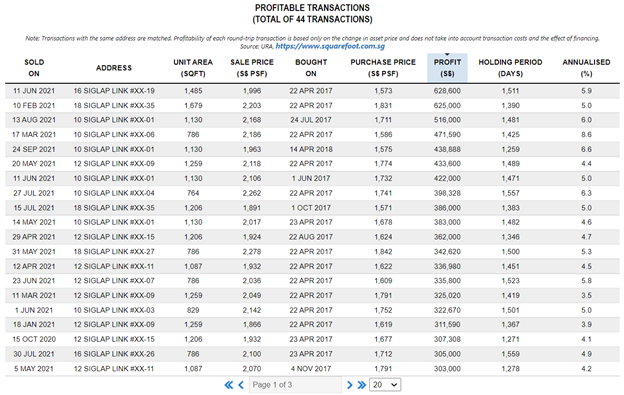

Here are the transaction details of units bought during the early days of their new launches.

They are newly completed and recently have received their Temporary Occupation Permit (TOP).

This means the owners have just collected their keys recently in 2021.

Below is the transaction data from Grandeur Park at Bedok South.

Below is the transaction data from Principal Gardens located near Commonwealth area.

Below is the transaction data from Seaside Residences at Siglap.

What do all these profitable transactions have in common with each other?

- These owners bought the units early when they were first launched for sale at a favorable price.

- Just 4 years ago, people thought the prices were very expensive.

- While they were waiting for the units to be completed, the price has increased significantly

- Upon completion, these owners realized their newly TOP units are very attractive to buyers

- They decided to cash out and made significant 6-figure gains within a 3 to 4 years period.

If you think about it, these owners were paid while they were waiting.

And what happens next after cashing out?

Well, they have no home or place to stay.

But they do have the funds set aside to buy another home or even a resale HDB if they wish to.

They now have more options to explore on what they can do next.

#5: A Significant Portion of Your CPF Monies Will Be Parked In Your Home

In Singapore, the vast majority of home owners will pay for their housing monthly installments via deductions from the CPF Ordinary Account.

If you do not buy any properties, the monies will sit pretty in your OA and helping you to earn an interest of 2.5%.

So the moment you purchase a home, you are essentially borrowing from your retirement monies at a cost of 2.5%.

That is an opportunity cost.

And I have not even considered the cost of the interest from the mortgage loan.

For the owners who bought Grandeur Park, Principal Gardens or Seaside Residences – they are sitting on very profitable returns of between 3% to 7%.

This is how you can make your monies work harder for you.

If you are going to pull out your CPF monies for your first home, you might as well find a good place to park it inside.

A place where you can beat inflation.

Conclusion

Inflation results in everything being more expensive.

But it also pulls up the price of your home.

The key is making sure you have the runway to catch up to rising prices.

I know some young couples might not face the affordability constraint.

Instead, they are aiming for the BTO because of the mindset of wanting a bite at the cherry.

This option I presented is actually a way to get the same results – but it is faster and sweeter.

For those who are considering buying a private property from the resale market, you will sacrifice short term gain for the convenience of immediate move-in.

In the long run, if you buy a reasonably decent property – the upside potential still exists.

But you need to really pay close attention to your entry price.

For buyers who want to enter the private resale market, you will have to put in more effort looking for good deals.

It is harder to determine which project is a good buy – because it also depends on the price of the unit and not just the project.

The goal of this article is to present more options to HDB buyers and show an alternative path to making better returns.

If the idea of paying high COV is undesirable because you feel you are throwing away good money after the bad, then I hope this article is beneficial.

Have questions?

Unsure of your next property choice?

Feel free to contact me for a no-obligation in-depth discussion with you and your spouse.

We usually do these sessions over Zoom.

Drop me a whatsapp message at https://wa.me/6598801790/