These clients of mine has been staying in their property for the past 21 years.

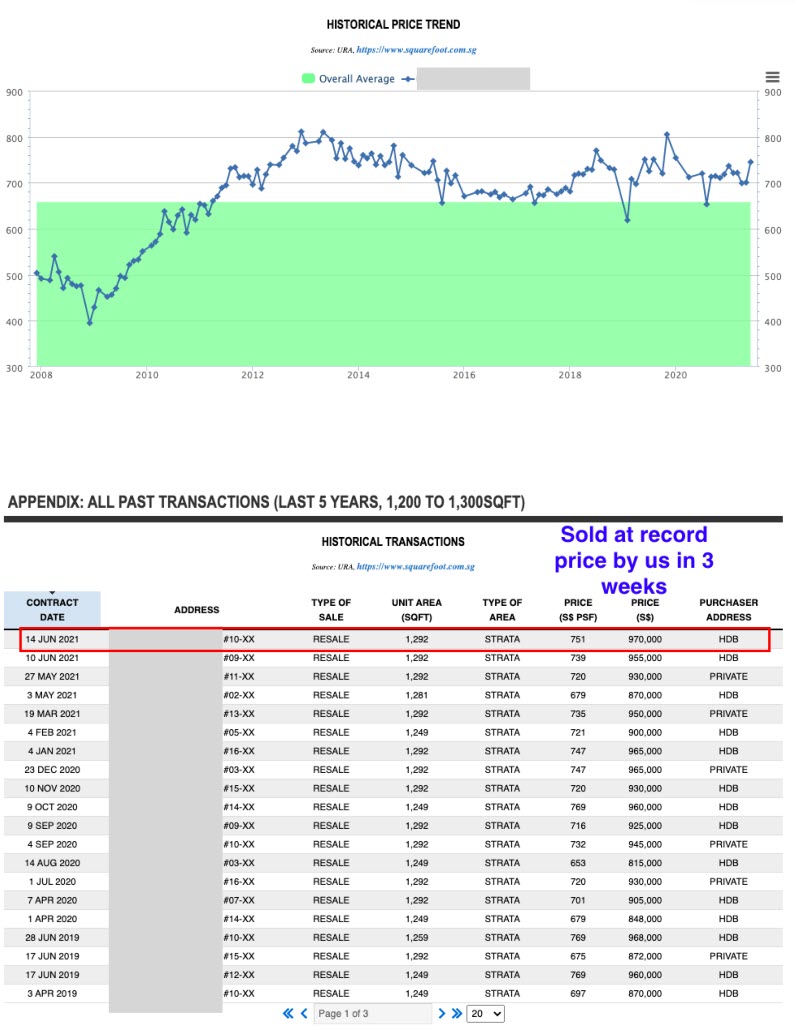

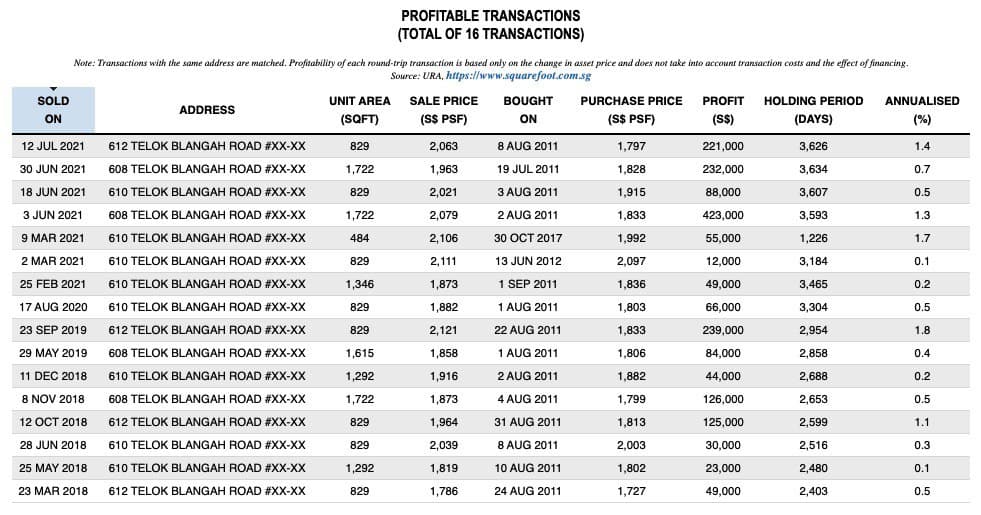

Last month in June 2021, I helped them to sell off this property at a record price within just 3 weeks of marketing.

Following that, I helped them purchase their next home which should hit TOP in end 2022.

Let’s explore their journey, the reasons and their motivations to make the move.

Current Home Was Facing A Stagnant Price

This couple was not a speculator by any means. They had been staying at their private condo development for the past 21 years.

Their property hit a peak price back in 2013 but they did not take any action. They continued to stay there – a relatively spacious unit with a size of 1292 sqft.

This was slightly bigger than the average 5-room HDB flat.

Early this year, they reached out to me for advice on their next property plans.

They felt that their current home – as spacious as it was – is starting to look old and dated.

But their main concerns was about affordability for their next home and whether selling now was the right move.

Old Properties Tend To Underperform the Property Price Index

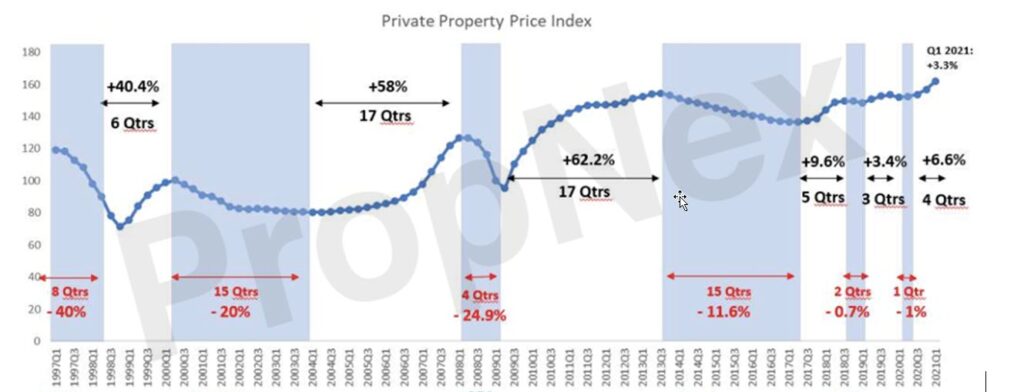

In 2013, the private property price index was at a new peak.

And because of the rising prices back then, various cooling measures was implemented – which included ABSD and tighter LTV limits.

Since hitting the peak price of 2013, their property price has remained stagnant while the private property price index continued to rise slowly.

Causes of Stagnant Private Property Prices

The property has had a good run from launch till the peak around 2013.

Following that, the price has pretty much remained stagnant – transacting between $6XX psf and $7XX psf.

Here are 5 reasons which might have contributed to this stagnation:

1) The availability of newer condos offering more facilities in the same location

The newer developments with their modern exteriors creates a feel good factor which is attractive. The older properties will usually be ignored and not considered.

2) As the property ages, the emotional pull of the property subsides

When buyers want to buy a home – there are usually driven by some emotions. As such, in some cases they might even be willing to pay more.

But such emotions are usually reserved for the newer homes.

Older properties on the other hand – will probably attract buyers who are more price-sensitive – rather than those more willing to spend on what they like.

3) Older property typically go through a period of stagnation until enbloc talks start to happen

Usually such older properties are ignored until they aged enough to warrant discussion of enbloc. But enbloc can take years to happen.

A good example is the old Pearlbank – which was finally collectively sold in 2018 – more than 11 years after the first attempt failed.

4) Buyers are also usually more cautious when purchasing a older leasehold property

Properties with a a limited remaining lease are usually heavily discounted by buyers. They tend to be more wary and are less likely to offer higher prices.

5) Poorly maintained units in the project pulled down the price

Some similar units in the development unfortunately was not as well-maintained and was transacted at lower prices.

This influenced the asking price we could set in my marketing efforts.

The Trap of Comfort and Complacency

The truth is this – many homeowners rarely check on the value of their homes until they have serious plans to sell.

And especially for this couple who bought their home at a relatively cheap price 21 years ago, they are very happy, satisfied and comfortable.

So it is a very easy trap to fall into especially since the initial years are so rosy.

They had missed twice actually to capture the gains in the property market:

- back in 2010, when the price index increased by over 60% which resulted in very comprehensive cooling measures

- back in 2017, when the price index started to rise slowly again

Had they sold and bought the right properties during those periods, they could have captured gains twice.

At the same time, holding on the unit could be quite detrimental as a significant portion of their retirement monies are stuck within that old property.

What the Property Price Index shows is this – property prices are rising but yours is underperforming.

It is even more painful to realize that everything else has increased in prices thanks to inflation…. except your own property prices.

So this was quite a wakeup call for them.

2021 Is A Great Year To Let Go of Your Old Properties

In any case, 2021 has presented to be a great year to sell as well especially with the limited supply of ready-to-move in units.

Coupled with the WFH trend for bigger homes, their spacious unit was in high demand.

After we sat down and discussed their next property plans, they finally made a decision to sell their existing property.

Selling will not be a big problem.

The issue was buying their next home – a property that could at least perform well and provide returns that are slightly better than inflation or the CPF interest rates.

How We Selected Their Next Home

For privacy reasons, I will not reveal the next property they purchased.

But there are 3 main factors why we picked this next development:

Factor #1: Their Needs as a Family

As much as possible, we will always work within the boundary that meets the needs of the family.

After all, we are buying a home and not a pure investment.

But we do want the best of both worlds – being able to meet the needs of the family and at the same time provide some decent capital appreciation.

In this case, we do have a undervalued project in the location my client wanted.

Factor #2: The Entry Price of the Development

First and foremost in selecting a project is the entry price.

I have seen many buyers falling into the trap of buying into a very appealing property by all measures, but at the wrong entry price.

When the entry price is wrong, the risk can be very high.

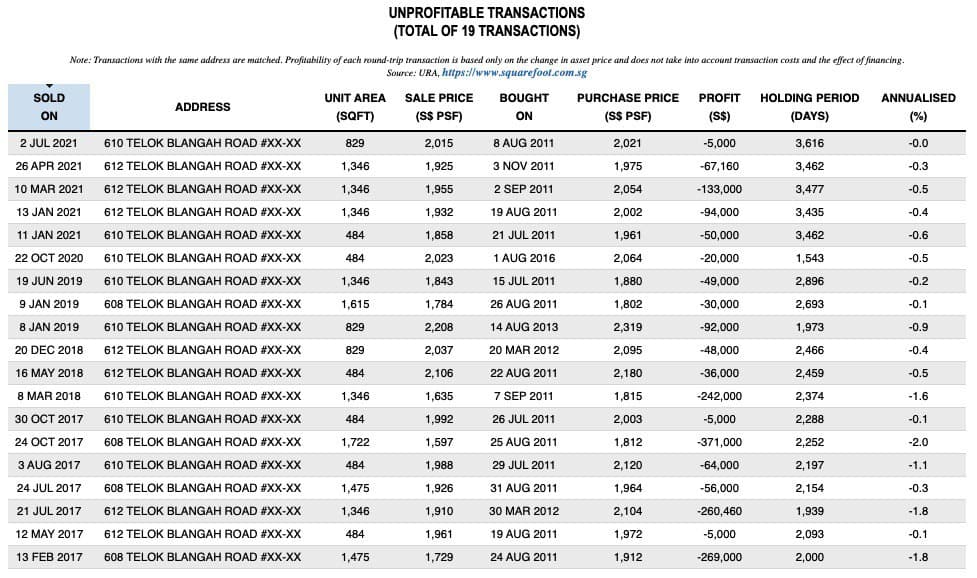

There are numerous examples of projects with very, very attractive attributes, but ended up losing money because of the wrong entry price.

Have you heard of Skyline Residences?

This freehold project is at a very good location – but a large number of units there are losing a lot of money.

And those that do make money – the annualized returns barely cover inflation and are worse than CPF returns.

Great location, freehold development does not always mean stellar investment returns.

In this case – entry prices plays an important role in ensuring you secure a good profit in the future.

Factor #3: The Ease of Exit In Future

One common mistake make by buyers is that they make their decision based on personal preference.

This is not wrong if you are prepared to pay for your own enjoyment and comfort.

However, if you are looking for capital gains – then what is important is being able to find out whether is there a strong pool of potential buyers.

This is critical in making sure the exit from the project is easy and profitable.

We are convinced that this project has the right attributes to attract strong pool of future buyers based on the demographics of the buyers in the location.

Conclusion

To be honest, they could have chosen to stay on and live comfortably at their old property.

They loved the place and had actually renovated it a few times. So it looked better than most of the other units in that development.

But they also realized the opportunity costs of holding on that home when they could have parked those monies in a better performing asset.

They could have captured gains a decade ago but they missed out.

And 2021 presented an irresistible opportunity to sell in a market with limited property supply but with strong demand from buyers.

Their risks have been minimized as much as possible. In fact, they need not worry about the monthly installments for more than 5 years as the funds have been reserved and are in place.

They are looking forward to moving to their new home soon.

I am grateful that they took the chance with me and I anticipate holding their hands and providing solid guidance in their next property journey.

At their age, there is still a chance to make 1 last good investment decision – and I am glad they took it.

Have questions regarding your own property portfolio? Planning to make big decisions soon about your home?

Feel free to contact me via WhatsApp or the contact form to arrange a no-obligation discussion.

You are welcome to ask me your biggest questions that might have been niggling on your mind for weeks or months.