I first met this couple back in 2014. Their HDB flat have just completed the 5-year MOP period.

This means they started their journey of property ownership back in 2009.

They shared with me that based from the mailers and agents knocking on their door, they have the opportunity to make a $300K profit if they chose to cash out and sell their HDB flat.

But they were feeling reluctant to proceed.

Here were the reasons they listed:

1) Convenience

The location of their HDB flat was very convenient as it was just next door to the MRT station.

Imagine being able to reach the MRT platform within just minutes of leaving your doorstep.

Yes, it was that convenient.

2) Fear of Taking a Larger Loan

If they were to upgrade, they will be taking on to a bigger loan.

This means a greater financial burden, as considering that their HDB flat can be fully paid off within the next few years.

3) Still “Too Early” To Let Go

They felt it was still too early to let go of their HDB flat as it was only 5-years old. So they wanted to enjoy the convenience awhile more.

So they believed they still have time to wait before taking any action.

I can understand where they are coming from.

Who would you want to give up a convenient home that is going to be paid off soon?

But at the same time, I can sense they understood that they are in a good position to do something with what they have.

It is an opportunity to level up and upgrade – not just their home but their wealth.

So we sat down and I showed them the plan and the numbers.

Disclaimer here: The numbers shown below are not the exact numbers but ballpark figures to keep my clients’ information private.

Step 1: Let go and sell their HDB flat at the perfect time

Their HDB flat was bought in 2009 at about $200K. That was around the period immediately after the Great Financial Recession of 2008.

After staying for 5 years, their outstanding loan is approximately $165k.

During this 5 year period, they have a CPF OA contribution of approximately of $800 each.

So together, they were contributing about $1600 per month.

The monthly payment of their HDB flat is about $700. So, $1600-$700= $900.

Hence during the 5 year period, they also built up CPF of approximately $54k.

I managed to secure a selling price of $500K for their relatively new HDB flat.

Here are the approximate numbers:

$500k (Sale price) – $165k (Outstanding loan) – 15k (various selling expenses)= $320k

Together with the $54k CPF they have accumulated, they now have approximately $374k.

Step 2: Identified their next home. Bought an Executive Condo (EC)

They purchased an Executive Condominium for $950k .

This required a down payment of approximately of $260k including stamp fee.

The monthly mortgage is now approximate $2500.

If you look at it, without touching any of their other savings, they still have a reserve fund of $374k – $260k = $114k

This funds should be set aside after purchasing the EC. (Not to be spent on other things!)

In terms of monthly mortgage of $2500, with a combined CPF OA contribution of $1600, they will need to top up $900 a month.

To pay this amount of $900 cash per month, they can choose to:

- Draw $500 per month from the reserve fund of $114K

- Fork out $400 per month from their own cash savings

Based on this, the reserve fund can fund the payments of the EC for 20 years.

The stress here is the $400 per month in cash that they have to top up.

Step 3: Cash out from their EC after 5 years

In 2022, I helped them to sell off their Executive Condo was again for $1.35mil, making a profit of $400k.

The approximate outstanding loan is $615k.

So their proceeds from the EC sale is approximately $700K.

Now with this amount of proceeds, they are in a very comfortable position to buy their next property.

More choices are now open to them to really grow their wealth.

Step 4: Identify and purchase the next home with growth potential

They made the decision to purchase a $1.2M home for their own stay.

I also helped them to purchase an investment property for $800K.

The total downpayment and stamp fee for the 2 properties was approximately $564k.

After purchasing the 2 properties:

$700k (from sales of EC) – $564k = $136k

They now have a reserve fund of $136k. (again this money is not meant to be spent on frivolous things)

Here is the breakdown of their monthly cashflow:

- -$3600 Mortgage for $1.2m property

- -$2400 Mortgage for $800k property

- +$2000 Monthly rental from the $800k property

- +$2400 Monthly CPF OA contribution

- Monthly Cash Flow= -$1600

So they now they have to fork out out $1600 per month in cash.

Here is one way to fund this $1600 per month:

- $500 cash from each spouse to total up to $1000

- $600 cash drawn down from their reserve fund of $136k

By planning out the funds in this way, it allows the reserve fund to last for about 19 years.

Stage 5: Planning Ahead

Once the 2 properties is fully paid off when they reach 65 years old, they do not even have to downgrade.

(But that option is available.)

They can continue to stay where they are and still have a passive income from their rented property.

Have You Figured Out Your Own Retirement Plan?

For this couple, what I did for them was essentially reviewing and restructuring their property portfolio – at regular intervals.

They understood they are still youngish and at peak earning potential.

More importantly, they understand that they are able to work hard at this season of their lives.

But is achieving all this growth and maximizing their returns on property really so necessary?

In today’s context of high inflation rates of 2022?

The answer is YES.

Inflation is now reaching new highs that has not been seen in decades.

Prices went up in most categories, with food inflation rising to 6.4% in August.

Posted by CNA on Thursday, September 22, 2022

Everything seems to be rising in price and it seems to be unavoidable.

So the best thing we can do now is to mitigate as our spending power is degrading?

We need to start to hedge against the eroding value of our cash.

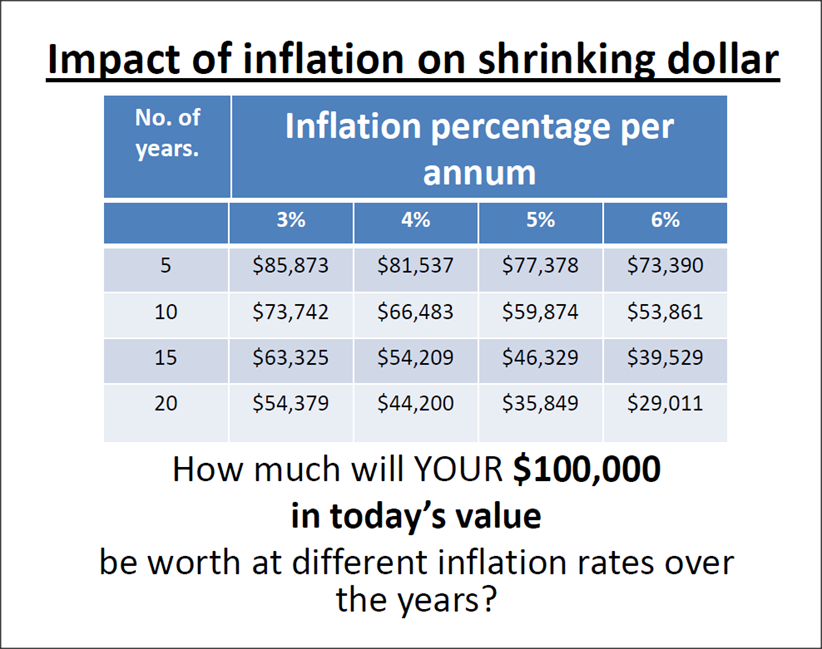

Rising prices for goods and services means your money buys less. The “rule of 72” can help gauge how quickly its value decreases.

Posted by CNBC on Sunday, May 15, 2022

Remember The Rule of 72

This rule of thumb is generally applied to investment returns.

It’s a back-of-the-envelope calculation that approximates how many years it will take investors to double their money at a certain interest rate.

But it also applies for inflation.

With an inflation rate of 6%, the Rule of 72 says that your current $100K cash will be worth only $50K in just 12 years. (72/6 = 12)

12 years is a long time.

And while the inflation rate is not always 6% – it seems that Singapore’s food inflation may double to 8%.

Singapore, South Korea and the Philippines will likely see the sharpest price increases for food in the region, according to Nomura Holdings.

Posted by The Straits Times on Monday, June 20, 2022

Choosing to take the uncomfortable route of letting go of their HDB flat to upgrade to an EC is not a choice that everyone will make.

But they did it.

Now 13 years on, they have 2 properties.

And instead of halving their spending power in 12 years, they hedged against inflation by choosing to park their monies in their properties.

The one good thing about inflation is that it also pulls up our property prices.

The Longevity Risk We All Face

With inflation reducing our purchasing power and pushing up the prices of goods and services, this means we have to:

- keep increasing our income

- keep trying to get better returns on our investments

- or lower our standards of living

Inflation therefore brings “longevity risk” into play for all of us—this being the likelihood that one will outlive one’s financial resources, or that a retiree will outlive their funds.

On top of our current and future lifestyle, today many of us in our 30s and 40s are already actively discussing about retirement.

Why?

Many of us wish to have a more financially independent retirement.

As many of us married and have children later, we could be in our 60s or 70s and our children in their late 20s or early 30s, just starting out in their career.

Are they able to take care of us financially?

Moreover, most of us also have lesser children to share the financial commitment of supporting us.

We have to depend on ourselves to secure our own retirement.

At the same time, the people I spoke to wish to be able to still have their own home rather than moving in with the children.

The truth is we don’t really intend to become very rich.

But we just want to become independent.

Property investment can be the vehicle you use to reach that destination.

We Are Now Living In An Era of Uncertainty and Disruption

One of my clients shared this with me:

There used to be a time where insurance is a taboo.

But now, it seems suddenly everybody is buying insurance.

Today, you might even be viewed as irresponsible if you do not get yourself minimally covered.

Now we have progressed beyond insurance for protection.

It is fair to say that we now see insurance as a form of risk mitigation to take care of ourselves and our loved ones.

It is about being proactive and taking preventive steps now – rather than just que sera sera, whatever will be, will be.

Is property the only way to invest?

Of course not. Stocks and shares are a great investment tool but they are volatile and prone to react very quickly to changing market sentiment.

Crypto was seen as another alternative but we seen that it is possible to go to zero.

At least with property, we can be sure it is unlikely to go to zero.

And because of that, making leveraged returns is possible.

With $274k in assets eg $50k cash and the rest in CPF, it is possible for you to own a $1 million property.

Not just that, the risk is low and spread over a long time period (eg 30 years loan tenure).

This is not possible with other investment vehicles.

Disclaimer: This is NOT suitable for everyone

To be clear, I have to say this property journey is not suitable for everyone.

You need not own multiple properties to grow your wealth. There are plenty of other ways.

By doing this, we are essentially making a bet that our property choices can provide better returns than just leaving the monies in our CPF OA.

Because if you look at it carefully, you are basically pulling out your own retirement monies to park it inside your properties.

You are also banking on the fact that you will be gainfully employed with regular CPF contributions for years to come.

So there are risks here that I must acknowledge.

Conclusion

Life is the lump sum of our choices.

Unfortunately though, our choices are driven by fear — fear of what might go wrong; fear of not having what it takes; fear of making a fool of ourselves, ‘found out’ as unworthy or inadequate in some way.

Often, we’re not even aware of how fear is pulling the invisible strings of our daily decisions.

But if you label those reasons or fear as mere excuses – then you can finally control your perspective and open up your mind towards solutions.

My hope with this case study is at least you have a better reference point on how other ordinary HDB owners have performed when they:

- made the decision to be uncomfortable and leave their comfort zone

- selected the right property choice

- take timely steps and act upon receiving new knowledge

- regularly review their property portfolio

Have questions? Feel free to drop me a message via whatsapp to arrange a no-obligation discussion.