If you been following the news for a while, you would have seen headlines about how much HDB resale prices has risen.

Thanks to the combination of the pandemic, construction delays and the Work From Home trend – a place to call home is in demand more than ever.

2021 presents a unique opportunity for you especially if you own a HDB flat currently.

In a situation where demand outstrips supply, should you consider selling your HDB flat this year?

Let’s explore the situation and find out.

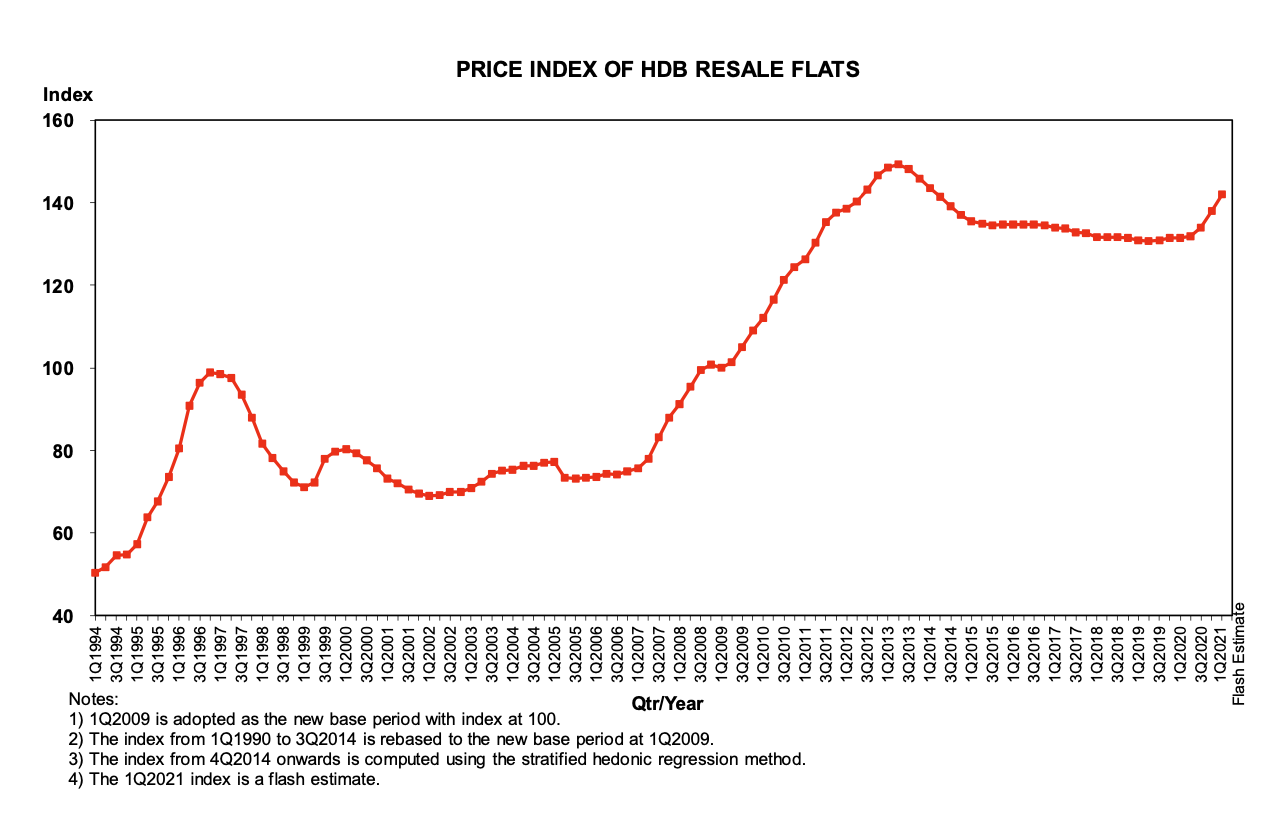

#1: The HDB Resale Price Index Is At Its Highest Point In 8 Years

HDB resale prices had shot up by 8.1 per cent following four consecutive quarters of increases in the past year.

Currently, the HDB resale price index is just 4.8 per cent below the last peak in 2013.

What does this mean?

For those HDB owners who has been struggling with the idea of declining HDB prices for the past few years – 2021 presents a unique opportunity for you to finally recapture those losses.

Pre-pandemic, I still remember calculating the negative cash sales situations that owners of aging HDB flats have to go through.

It discouraged a lot of HDB owners as the paper losses can be substantial due to CPF accrued interest and the lack of demand for their older HDB flats.

But with demand outpacing supply this time around, HDB resale prices are finally going up again.

#2: An Opportunity To Recover From a Negative Cash Sales Situation

Before the pandemic, the only flats in high demand were the newly-MOP 5-year old HDB flats.

It was understandable as people wanted a home that still had a very long remaining lease.

But with the ongoing pandemic and construction delays, buyers are now more open to buying even older HDB flats.

Their bigger size is also an attractive factor and this has contributed to overall demand.

How significant is the demand?

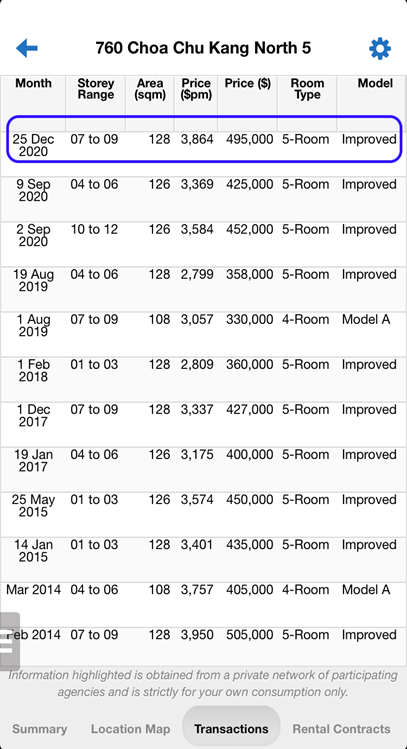

Well, it has helped pushed up prices for this 26-year old HDB flat to a new record high.

For this 26-year old HDB flat in Choa Chu Kang which I personally transacted at $495K – it came as a surprise as I did not expect that big of a gap compared to the last transacted price.

This price certainly helped the owner recover back what he initially put in and closed the gap on losses he could have incurred if he had sold in the pre-pandemic period.

#3: Selling Is Now About Negotiation

One of the shifts I noticed in this hot property market in 2021 is that my own behaviour has changed.

In the past, I used to market the physical unit and show off the best parts of living in that location.

But in 2021, it is all about negotiation due the large number of interested enquiries that come in with every new listing.

Together with the COVID-19 restrictions of 5 visitors per household – this meant that I have to carefully filter all enquiries to decide who are the serious buyers.

This meant I have to conduct some upfront interviewing before the actual viewing is done – in order to prequalify all enquiries to make sure only the most serious and willing buyers can come for viewings.

With some of these buyers having gone through several rejections – majority of them becomes very keen and serious in their offer prices.

That is one of the reasons why you see record prices even for those older HDB flats.

#4: If You Plan To Sell and Buy Another Home In 2021, Be Prepared To Pay High As Well

Let’s take a look at whats happening on the ground…

There is definitely no HNW investors from oversea buying up the HDBs. What I am observing on the ground is a surge in the number of buyers.

I am receiving many enquiries and am unable to accommodate all the viewing requests.

At the same time, I am also seeing lesser listings in the market which means there are lesser sellers.

My observation and analysis is this:-

Surge in the number of buyers:

A delay in the BTO has pushed more HDB buyers to the resale market. Some of the buyers may also be downgrading from private condo due to the pandemic. They may also have the means and ability to pay more.

Lesser listings:

As most HDB owners will only sell their HDB if they are upgrading to a private, the pandemic may have affected the plans of some of the potential sellers. They may have chose to delay their plans to upgrade in view of job uncertainty.

And the outcome with basic supply and demand principle… price went up.

So this is where I like to caution you that if you plan to sell your 4-room HDB and purchase a 5-room HDB which is in high demand now – you have to be prepared to pay more.

But if you are planning to downsize to a smaller unit – from a 5-room to a 3-room for instance – than 2021 might be the best time to capture and capitalize on that gains.

So do consider seriously what will your next plans be after selling your home.

If you plan to sell – do your best to secure the best price possible so you can have some additional margin to help you in the purchase of your next home.

#5: HDB Flat Prices Will Stabilize Once BTO Supply Catches Up

Being an agent for the past 12 years, I have seen the many up and down cycles of the Singapore property market.

This current hot market is similar to what happened back in 2012 when there was not enough BTO flat supply available to cater to the demand.

Currently, the construction delays are what is causing buyers to turn the HDB resale market instead.

However, once the BTO supply catches up, the HDB prices will eventually stabilize.

The government is very mindful of this trend of rising prices especially for the HDB resale market especially when it happens due to construction delays.

BTO flats are well-known to be completed ahead of deadlines so once workers are able to return to work and construction is resumed at normal pace – this means the BTO supply will catch up soon.

With vaccinations ongoing – this might just be a matter of time before HDB prices return back to normal levels.

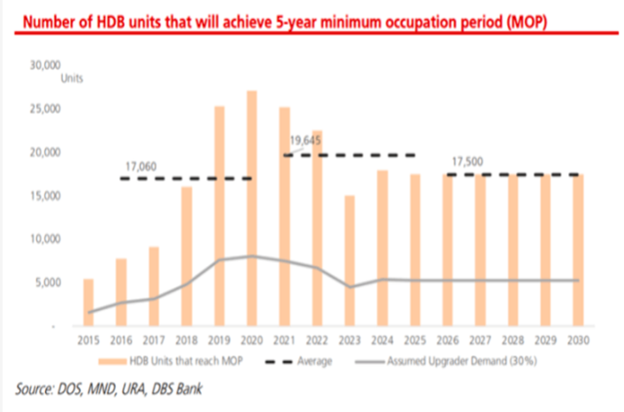

In 2021 and 2022, we are seeing record numbers of HDB reaching MOP.

Supply will eventually outpace demand, the market becomes less exuberant and prices will eventually go down to more rational levels.

Conclusion

Selling your HDB flat in 2021 might be the best chance for you to finally recover from negative sales or even making a small gain – especially if your flat is the older type that is more than 10-20 years old.

However it is also a big decision and I must caution you to sit down and plan your next steps carefully.

Sometimes staying put might be the better option.

If you have questions and unsure of what to do next, I invite you to contact me for a no-obligation discussion so we can do a thorough analysis of your financial numbers as well as discuss your potential options.

If you like to find out how you can:

- get record price for your HDB

- how you can leverage on the current exuberant HDB market to plan a seamless upgrade

- choose the right property that can appreciate

Feel free to drop me a whatsapp message with your questions.

Here’s some case studies that I have featured to help you understand what you can do with your current HDB.